The US and the UK Master’s Part / Chapter-wise Dissertation Writing Service

Then You’ve Certainly Reached the Right place

Comparison of Case Study – BP versus SHELL

Introduction

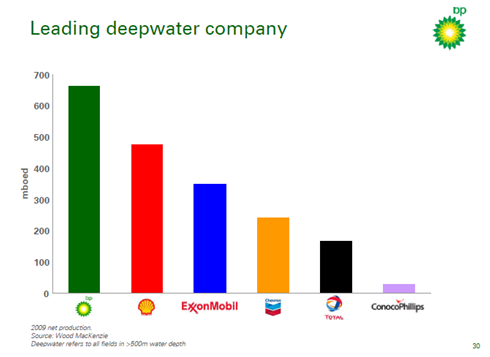

The global energy market is highly volatile. Factors such as demographics, urbanization, liberalization of the market and the soaring demand for energy contribute to the volatility of the energy market. British Petroleum is the world’s second-largest energy company, and Royal/Dutch Shell Group (Shell) is the world’s third-largest energy company. The trend towards alternative energy is already seen in the (SBUs) that belong to the Shell Renewable and BP Solar and groups. As oil stocks diminish, the search for solutions that will offer low-cost alternatives is on. Among the major players, BP has the financial resources to fund research in such critical areas, but Shell Renewable is more technically equipped.

This difference in capabilities of the two major players has reflected in their respective business strategies also. While BP Solar has invested much less financially than it is capable of Shell Renewable has pooled in its resources for the acquisition of businesses and joint ventures. However, the recent oil reserve scandal on Shell corporate will weaken its position when competing with BP Solar. As of the present-day scenario, the alternative energy market will take much more time to reach a significant level in the global energy business scenario, and until then BP and Shell must invest in futuristic technologies without overburdening their financial advantage obtained from their oil oriented market (Frynas, 2003).

SBU Strategies

The strategies employed by the SBUs of BP and Shell are discussed below.

Shell Renewable

Shell works towards the vision of becoming a leading player in energy in the coming century (Shell Renewables, 2004a). Shell envisions that by 2060 solar cells would be the major source of renewable clean energy (Modern Power Systems, 2001) as the world energy market is expected to move towards a more diverse system: that began from coal, moved to gas and finally to renewables (Shell Renewables, 2004b). The key to achieving this is through photovoltaic technologies that can be supplied at low costs by a mass production technique: a program that has already engaged $1 billion (Modern Power Systems, 2001). The company has already acquired solar businesses held by companies such as Siemens, Eon and has joint ventures with Akzo Nobel, Netherlands. This would confer a long-term competitive advantage and boost short-term market share.

BP Solar

With the aim of making solar energy economically competitive, the thin film photovoltaic cells have been designed by BP that have very less manufacturing costs. BP’s strategy towards alternative energy is through huge investments in its manufacturing processes. The vital problem faced by the alternative energy sector is the fact that if a large volume of sales is not promised it would result in loss of valuable incentives. This would make the project cost inefficient, and the product could not be commercially good (Chambers, 1998, p. 6). BP Solar addressed these issues with a large advertising campaign that puts renewable energy at the forefront. This move incurred heavy criticism from Fortune Magazine (2002) as the net renewable energy business of BP solar was only for $1 billion while BP’s total income from non-renewables was found to be £115% billion according to Murphy, 2002.

External Analysis

"The essence of formulating a competitive strategy is relating a company to its environment" (Porter, 1985: p. 3). The competitors define the environment, and hence the following strategies may be employed.

- Reducing cost

- Focus

- Differentiation

These strategies will help compete profitably in the market. In our case, the strategy employed by both companies is to work towards presenting a cost effective solution.

Researchers to mentor-We write your Assignments & Dissertation

With our team of researchers & Statisticians - Tutors India guarantees your grade & acceptance!

About service- Pest

- Porter's five forces

- Critical success factors (CSFs) and Drivers for change

Pest

The industry is affected politically, socially and legally according to the Kyoto Agreement (UNFCCC, 2004), and therefore there is an acceleration towards the use of more sustainable and renewable energy, that calls for energy generation companies like Shell and BP to adapt (Hoffman, 2004, Modern Power Systems, 2002).

Political

Geopolitical instability contributes a major threat to the World energy market. In the light of climatic destabilizations due to CO2 emissions, governments of leading nations are encouraging the use of energy that is more sustaining. The Chinese economy is booming, and with it their oil requirements are also growing. This contributes further to the existing volatility and results in international tension (Wright, 2004).

Economic

The IEA report of 2004 says that ‘Its energy supply underpins economy.' With the rising demand of energy, the percentage met by fossil fuels remains the share although the nuclear and renewable energy sectors have also made relative contributions which have grown from 2% in 2002 towards 6% in the next 30 years (IEA, 2004).

Social

The sustainability of the future is a huge concern for people worldwide, and everyone is on the lookout for eco-friendly energy solutions. The Carbon Funds instituted by World Bank, 2004 and emission trading instituted by the EU, 2004 have now become legal requirements around the world. However, one cannot expect this to change the energy market overnight. Further, both oil companies need to care about the safety, and this is particularly raised after the incident of Oil Spill in Gulf Mexico which killed 11 people and number of sea water animals are dead

Technology

Technology is another vital criterion according to the IEA which states that the market for alternative energy will be limited by the need for technological advancement (IEA, 2004). As far as the alternative energy industry goes, technical competence is the key to market dominance.

Porter's Five Forces

The competition is very high as both companies have the same low-cost approach through strategies that are quite different from each other. However, market control according to previous research Porter (1985), is possible only for one company. Hence, it is very important to achieve this critical position.

Porters Five Forces Analysis

Barriers to Entry

At this time, the alternative energy industry is traversing a learning phase where technological development is being considered as the main focus. The stringency regarding government policies and requirements make it further difficult to operate in this industry. Further, the nature of the market demands an ethical brand identity, and this again places a major setback on the major players due to their high inputs in the non-renewable energy sector. The last market barrier identified is the requirement of a huge access to distribution network so that energy can be provided on a widespread basis.

Threat of Substitutes

Although the consumers would prefer an alternative energy supply that can substitute non-renewable energy, the cost barrier is too high to overcome. As alternative energy costs more, the cost barrier overcomes the growing motive of consumers to opt for clean energy. Hence, trade-offs based on performance between substitutes happens at the consumer choice level as the traditional energy provision is considered cost-effective better regarding reliability than alternative energy.

Competitive Rivalry

As the barriers are very high against the industry concentration which is very low and fixed costs are also high, compounded by the fact that this sector is itself a slow growing sector, the alternative energy concept is still vital when we consider the future of energy industries. The rationale for investments and entry into the industry is very diverse among the rival players themselves. For, e.g., While shell renewable has high corporate stakes, BP Solar has low corporate stakes.

Bargaining Power of Buyers

Regarding the energy industry, the buyers have a low bargaining leverage. To compound this, the buyer volume is also very low. Further, there is low buyer information. The critical factor is brand identity. The high availability of cheaper substitutes has a telling effect on the industry. There are higher incentives for the buyers, such as breaks in tax payments and buy-backs.

Bargaining Power of Suppliers

The principal suppliers of alternative energy are only BP Solar and Shell Renewables. There is a very low concentration of other alternative energy suppliers. For these companies to compete effectively, the focus is on low cost and economies of scale because the volume is proportional to industry development and survival.

Drivers for Change and Critical Success Factors

The desired competitive advantage for the companies can be achieved by using their internal resources to the maximum (Barney, 1991) at the same time; the environmental challenges must also be accommodated so that the opportunities obtained can be exploited fully and the weaknesses shown can be minimized.

CSFs for the commercialization alternative energy

Regarding technological critical success factors, the primary CFSs are the presence of a technological design that is feasible, that can be enabled, that will fit into the infrastructure, that can generate cost-effective, accessible fuel, increase the availability and possess a modular design are vital. The secondary CSFs in this sector include the lookout for a fuel source that is renewable or based on waste recycling so that the capacity factor can be increased power density can be increased and the quality of power generated without infrastructure breakdowns is enhanced. Regarding Commercial CSFs, the primary factors include, the presence of a value proposition that is compelling, an improved lifecycle cost, the existence of economies of scale, opportunities and access to markets, doing away with current energy markets that are undesirable and encouraging the development of well-managed industries. Regarding Socio-Political CSFs, the primary factors include support at the international level, insecurities in the supply of energy, government support, deregulation of markets, consumer, financier, investor, utility level buy-ins energy supply, reputation, generating favorable impression and seeking to benefit the environment. The secondary considerations include precaution principles, carbon constraints, constraints regarding projects, a benefit for the society and acceptance. Regarding Organisational CSFs, the primary factors include strong endorsements, strategies that show proactiveness, cultures that support innovation, a resource enabling, strategical planning and incorporation of autonomous groups to promote new ventures, management efficiency, and finally attainment of results that can be achieved, attained and measured. The secondary considerations include the reputation that service quality is very high, there is constant room for development and a persistent approach.

Internal Analysis

Any organization, to simply stay in business, must be capable of generating some products that cross a minimum threshold, by leveraging minimum resources and competencies (Johnson and Scholes, 2002). To outperform the competitors, it is vital to meet the CSFs so that organizations can pool in the unique resources and competent cores so that productivity is achieved. Hence an internal analysis is required based on the factors that have contributed to the success and those that have impeded performance in the SBUs in the past. This studied regarding a brief financial performance and stakeholder analysis.

Brief Financial Analysis

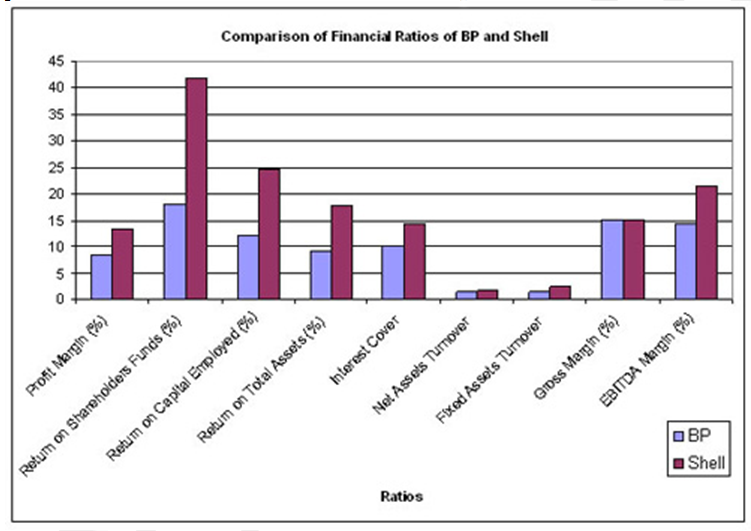

The parent company’s financial performance was analyzed and compared regarding profit margin generated; return obtained on the capital employed (ROCE); amount covered by interest; return obtained on the shareholders’ funds (ROSF); the turnover of all assets; return obtained on total assets; gross margin and EBITDA.

Regarding analyzing the return on capital employed Shell's performance was 8.0% on an average and planning to gear 15.5% a fourth-quarter year of 2009 compared to 5.9% 2008 fourth quarter year, while BP's returns were only amounting to 12%. Therefore, the efficiency regarding utilizing the employed capital resources and converting it to revenue has been more for Shell when compared to BP’s (twice lower) (McMenamin, 1999). Thus comparatively, Shell has more efficiency than BP regarding using the funds of the shareholders to generate profits. When the stocks of industries that are similar to each other are compared, the analysis of the profit margin is of vital importance (Brealey and Myers, 2000). Regarding this, shell’s profit margin of 14% is again much more than BP groups 8% thereby indicating that shell is more profitable than BP. Regarding interest cover and EBITDA also Shell's performance has been better than that of BP's average.

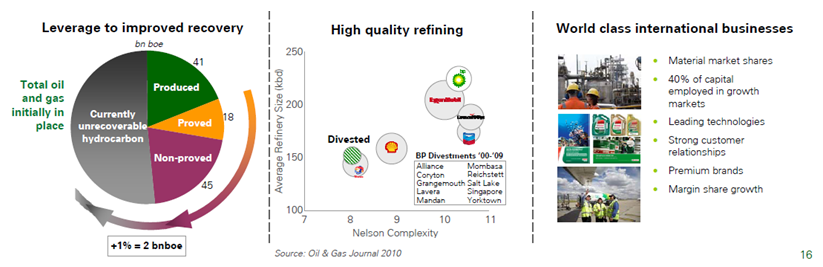

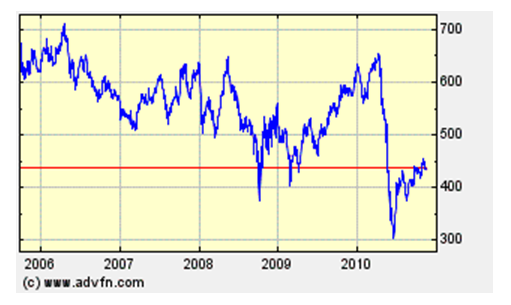

A comparison of the share prices during the past year, as shown in the chart below presents that Shells share price is lower than BP's. This can be explained by the fact that although shells performance is better than BP, regarding investor confidence, BP supersedes Shell. This lack of confidence on shell might be due to the exposure of shell to the vulnerable situation of Shell in the market owing to the conflicts in the Middle East.

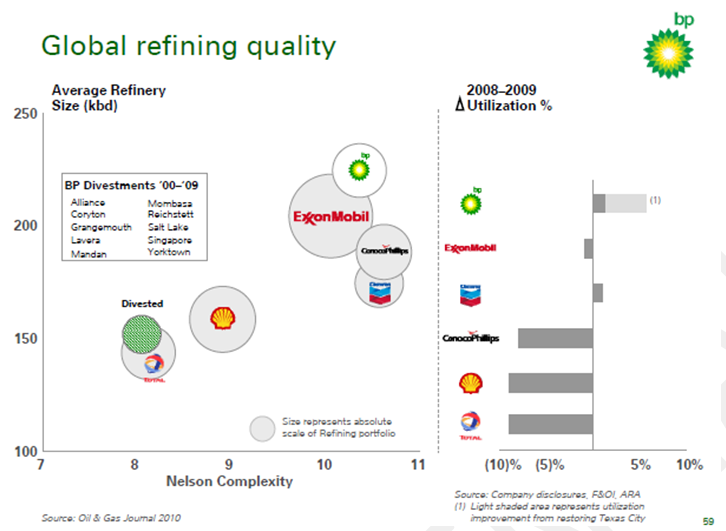

Global Refining quality

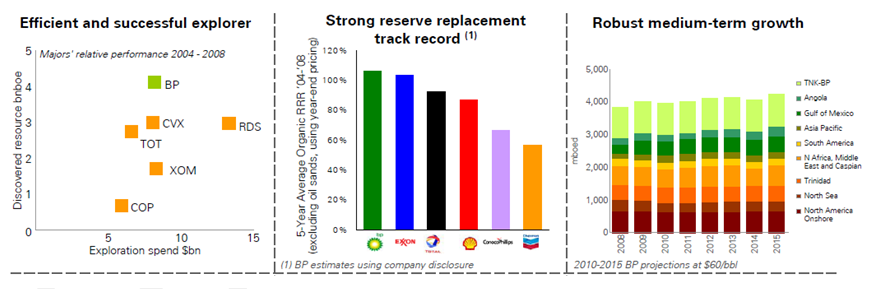

The above figure shows the global refining quality where BP leads with average refinery size (kb) than a shell.

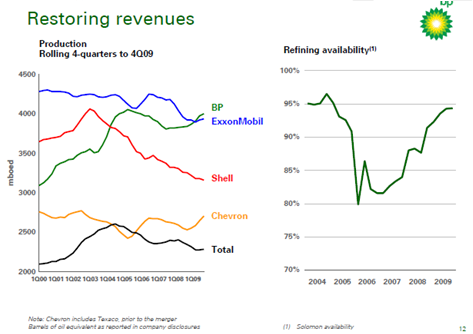

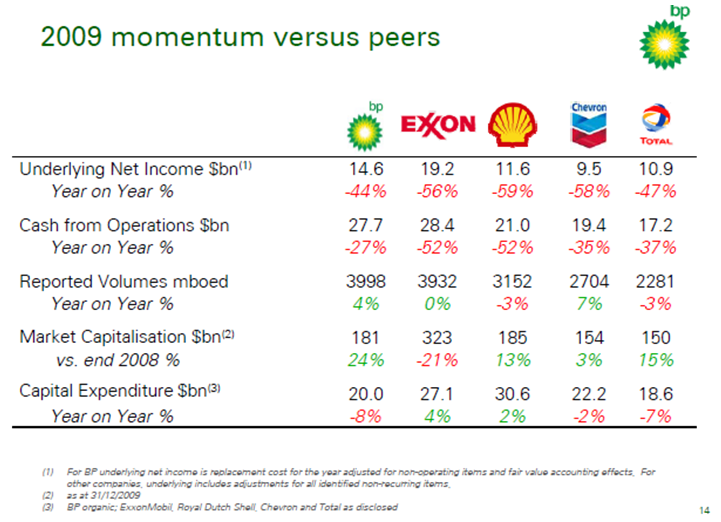

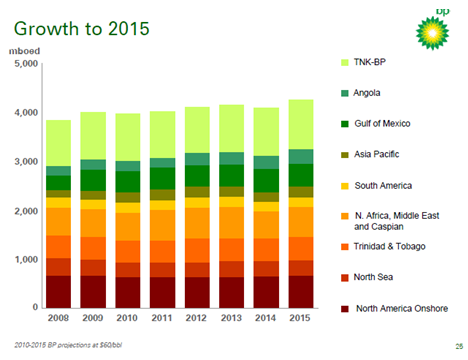

Restoring Revenues – Production structure

Regarding restoring revenue, BP leads in comparison to Shell. Further underlying net income, cash from operations, market capitalization all lead by BP than Shell.

The further figure below shows the reserve replacement record where BP leads and SHELL only in the fourth.

Comparison of the Share Prices: Shell and BP Groups (2004)

Competitive Position

Market Share of BP versus Shell

Recently the market value of BP is about $67 billion (43 billion pounds) lower than its competitors due to June 30th crisis. About 4.6% rise for The Hague-based Shell, Europe’s largest oil company but for BP the rise was only 0.2 percent. Thus, an enormous amount of pressure made BP sell their assets worth of $30 billion to pay their dividends, according to the investors (Swint, 2010).

BP Share price [5 years] %1$s Share Price (5 years)

Customer characteristics

Growth characteristic

Source: bp.com 2010

Stakeholder Analysis

The stakeholder analysis indicates that Shell Renewable has more support than BP Solar from the stakeholders such as shareholders, the Shell Board, and environmentalists. Shell’s is considerably experienced in the concept of scenario planning. This asset has always been helpful to gain a competitive advantage in the past. This also predisposes the shareholders to be more supportive of Shell's move into renewable energy. Alternately, BP has been performing poorly in this respect. The major oil competitors also have not made the transition favoring renewable energy. Considering this, it is more difficult for BP to convince the shareholders to embrace BP Solar.

Potential Impediments in Performance

To be able to stay-in-business, the energy demands have to be met by both SBUs.to do this, financial resources have to be employed which must be combined with the professional competency to discover and maintain oil reserves. This is the major limitation that affects investments in alternate energy. Since this underpins their ability to invest in alternative energy markets.

In 2004, BP had the second largest stocks, up 19 percent, whereas Shell was the third largest in the industry. Shell admitted that it had overstated its reserves by 24 percent, and was fined US$120 million, leaving shares down 6 percent (Barker, 2004; Berman, 2004). In response, Shell has declared that it will raise up to $12 billion through sales of its assets and invest around $45 billion to increase production (Economist, 2004), investing up to $1 billion in alternative energy, according to a report in 2002 (International Power Generation, 2002). The cost of such asset restructuring will be much high that it will annul the good performance in the past years. Although BP has not been performing as well as shell, it does not have the added burden of such impediments and hence is in a much better financial position when compared to the shell.

Technologically, both Shell and BP have invested regarding improving the technical design so that it is more feasible and compatible with their existing infrastructure, increasing the availability and the capacity and thus have invested appropriately in most of the critical success factors outlined. However, both do it in different ways. While Shell pools in its experience in running the project and has taken up acquisitions and joint ventures to achieve this, BP has brought in financial muscle.

The external analysis done in terms of the socio-political CSFs clearly shows that both the energy companies draw their benefit from the existence of insecurities in the energy supply, policies from the governments that are supportive of the energy sector, increasing buy-ins from consumers, the beneficial effect of the environment, carbon constraints and ultimately beneficial to the society. Although the damage of reputation has given Shell Renewables a negative impression on one hand; on the other hand, the act of BP Solar's move to renewable energies is under severe criticism as there appears to be no financial spine to their advocacies.

Considering the organizational CSFs, the proactive strategy adopted by Shell Renewables’s has drawn strong endorsements while same arguments by BP are less compelling. Shell’s scenario planning is impeccable, which set the stage for Shell's management to make profit out if the the 1973 oil crisis by capitalisation strategies that involved buying many oil fields in prior when the price was low, and then when there was a rise in the prices, the fields were sold off making a huge profit for the company.

The undesirability of present day energy markets is recognized by both companies; their approaches are different. While BP Solar seems reluctant in the context of investing until the more commercially viable promise is apparent, Shell Renewables puts forward a more compelling value proposition. Shells acquisition strategy and joint ventures. This will help shell to gain access to the market by building cost effective techniques that can be mass produced so that profit can be derived from economies of scale. To gain market access and joint venture agreements will help to not only build lower cost technologies, but mass produces them, benefiting from economies of scale.

Source: bp.com 2010

Conclusions

The energy industry and more specifically, the alternative energy market have been analyzed in this paper regarding the business environment, drivers of change and CSF principles. The focus of the study has been the two competing SBUs, BP Solar, which belongs to the BP Group, and Shell Renewables, which belongs to the Royal/Dutch Shell Group. The analysis has shown that:

- The dominance of Oil driven energy through renewable are fast catching up: The energy industry remains dominated by oil production. This dominance is driven by demand due demographic variations, changes in favor of urbanization, increasing income levels and the liberalization of the market. Despite this, the industry is evolving. The reasons for this evolution being, diminishing oil supplies, which will lead to the point where the long-term strategic need would be renewable energy.

- CSFs: Technology leadership still stands as the important criteria.

- Business Strategies: The two SBUs employ different strategies. They use their available resources and abilities very differently. Here, BP Solar’s leverage is the possession of a huge financial resource, as financial stability is vital to maintain market supremacy. This is achieved by concentrating on its core, oil business although both are opposite poles for which BP has been severely criticized. Shell Renewables, on the other hand, has shown and proven over time its skill regarding project management, and its technical supremacy through many strategic acquisitions and joint ventures. This has helped Shell to increase its market stake competitively.

- Impediments: BP Solar has not faced many impediments concerning performance. Hence the new strategy is taking planned, cautious decisions in alternative energy. Shell Renewables, on the other hand, is threatened by the evident financial restructuring and its implications that loom ahead shortly.

BP Solar and Shell Renewables have presented an interesting comparative study. It has shown how the two SBUs, which are similarly successful take dissimilar strategic approaches towards alternative energy.

References

Barker, R. (2004) An oil giant for players with patience, Business Week, 3904, p. 148.

Barney, J. (1991). Firm resources and sustained competitive advantage,” Journal of Management, 17(1), pp. 99-121.

Berman, P. (2004) Humbled giant, Forbes, 174(10), pp. 206-07.

Brealey, R., & Myers, S. (2000). Principals of Corporate Finance, 6th Edition, Irwin McGeaw- Hill, London

Broadhurst, A. (2000) Corporations and the ethics of social responsibility: an emerging regime of expansion and Compliance, Business Ethics: A European Review, 9(2), pp. 86-98.

Chambers, A. (1998) BP opens Californian solar power plant, Power Engineering, 102(4), p. 6.

Chemical Market Reporter (2001) Energy markets poised for dramatic change, Chemical Market Reporter, 260(17), p. 8.

Economist (2004) Business, Economist, 372(8394), p. 1.

EU (2004) The European Union Greenhouse Gas Emission Trading Scheme, EUROPA, http://europa.eu.int/comm/environment/climat/emission.htm [Accessed 21 November 2004].

European Power News (1998) Oil giants, European Power News, 23(5), p. 18.

Frynas, J.G. (2003) Royal Dutch/Shell, New Political Economy, 8(2), pp. 275-286.

Hoffman, A. (2004) Winning the greenhouse gas game, Harvard Business Review, 82(4), pp. 20-21.

IEA (2004) World energy outlook 2004, International Energy Agency, www.iea.org

International Power Generation (2002) Solar power by Shell, International Power Generation, 25(2), p. 7.

Johnson, G. and Scholes, K. (2002) Exploring Corporate Strategy: Text and Cases. Harlow, Essex: Pearson Education Limited.

Macleod Institute (2003) The critical success factors for the commercial application of emerging alternative energy technologies, Innovation in Alternative Energy Workshop, www.thecis.ca [Accessed 21 November 2004]

McMenamin, J., (1999). Financial Management: An Introduction. Routlege, London

Mirvis, P.H. (2000) Transformation at Shell: commerce and citizenship, Business and Society Review, 105(1), pp. 63-84.

Modern Power Systems (1997) Shell invests in renewables, Modern Power Systems, 17(11), p. 12.

Modern Power Systems (2000) World Digest, Modern Power Systems, 20(7), p. 9-11.

Modern Power Systems (2001) Shell and Akzo Nobel solar venture, Modern Power Systems, 21(11), p. 12.

Modern Power Systems (2002) First pollution trading, Modern Power Systems, 22(5), p. 3.

Rajgor, G. (2001) Earth, wind and power, Director, 55(2), p. 96-99.

Porter, M.E. (1980). Competitive strategy: techniques for analysing industries and competitors. New York: Free Press.

Porter, M.E. (1985). Competitive advantage: creating and sustaining superior performance. New York: Free Press.

Murphy, C. (2002) Is BP beyond petroleum? Hardly, Fortune, 146(6), pp. 44-45.

Power Economics (2001) Bright future for renewables, Power Economics, 5(3), p. 7.

Power Engineering (2000) Briefly noted, Power Engineering, 104(9), p. 78.

Shell Renewables (2004a) About Shell Renewables, www.shell.com [Accessed 21 November 2004].

Shell Renewables (2004b) Energy needs, choices and possibilities – scenarios to 2050, www.shell.com [Accessed 21 November 2004].

Teske, S. (2003) Solar, wind energy good for Asia, Jakarta Post (Indonesia), EBSCO database.

UNFCCC (2004) The convention and Kyoto Protocol, The United Nations Framework Convention on Climate Change, http://unfccc.int/resource/convkp.html [Accessed 21 November 04].

Wack, P. (1985a) Scenarios: unchartered waters ahead, Harvard Business Review, 63(5), pp. 72-89.

Wack, P. (1985b) Scenarios: shooting the rapids, Harvard Business Review, 63(6), pp. 139-150.

World Bank (2004) Carbon Fund, World Bank, http://carbonfinance.org/router.cfm?Page=About [Accessed 21 November 2004].

Wright, W. (2004) Anxiety grows over rising prices, Global Finance, 18(6), p. 9.

http://www.londonstockexchnage.com – Share Price Performance

http://www.shell.com/home/Framework?siteId=investor-en – Shell' annual reports

http://www.bp.com/investorhome.do?categoryId=132&contentId=2004195 – BP's annual reports

Swint, B (25 October 2010). BP Trailing Shell Puts Pressure on Dudley to Restore Dividend. Bloomberg Anywhere. http://www.bloomberg.com/news/2010-10-24/bp-trailing-shell-by-most-since-june-pressures-dudley-to-restore-dividend.html

Full Fledged Academic Writing & Editing services

Original and high-standard Content

Plagiarism free document

Fully referenced with high quality peer reviewed journals & textbooks

On-time delivery

Unlimited Revisions

On call /in-person brainstorming session

More From TutorsIndia

Coursework Index Dissertation Index Dissertation Proposal Research Methodologies Literature Review Manuscript DevelopmentREQUEST REMOVAL