The US and the UK Master’s Part / Chapter-wise Dissertation Writing Service

Then You’ve Certainly Reached the Right place

Is effective risk management practices be a competitive advantages for sustained earnings for commercial Banks in Nigeria? – An Empirical Study

Abstract

The banking industry faces immense pressure in terms of regulatory and changes in consumer expectations. In order meet the demands and create competitive advantage, there is a need for effective risk management strategy. Given this background, the study aimed to identify the specific risk management strategies adopted by the selected banks in Nigeria and determined whether those strategies does created competitive advantage to those banks. In order to test the objectives, the study employed the quantitative study methodology, where data was collected from the employees of Nigerian commercial banks to determine the risks management practices. The findings showed that all operations, credit, operations, market and liquidity risks are important for creation of competitive advantage as indicated by the employees. However, operational risks was showed medium to high correlation than other risks, while liquidity was considered an important risk in order to create competitive advantage of the firm as revealed by the participants. Further, the relationship between different type of risk namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage and assessed whether the risk management practices adopted by Nigerian Commercial banks is moderates the relationship. The findings revealed that risk management practices do moderate the relationship where it accounted 99.8% variance with highly significant at p<0.01. Thus, the banks in Nigeria need to adopt risk management practices in order to create sustainable advantage of the different risks being faced in uncertainty environment

1.0. Introduction

Risk management is evolving concept which has been utilized from the beginning of human kind (Dima & Orzea, 2011). It is used as a measure to identify, analyze and respond to a specific risk (Kanchu & Kumar, 2013), while risk management aims to reduce the level of risk (Remeikienė & Startienė, 2007). In general banks are exposed to three types of risks which includes credit, operational risk and market risk (Global Association of Risk Professional, 2009 ). This classification of risks in banking has also been attempted by financial analysts and researchers. Anthony Santomero has typified on the basis of service types as: systematic or market risk (interest rate risk), credit risk, counterparty risk, liquidity risk, operational risk, and legal risks (The Wharton Financial Institutions Center, 1997). In order to mitigate and manage the above risks, banks require well-defined risk management strategies that have to be taken in to account for the regulatory requirements.

The methods employed to minimize the consequences of the losses incurred can be defined as risk management (Schmit & Roth, 1990; Redja, 1998). Analysis, detection and governance are the three methods employed in the mitigation of the risks. The major focus of the risk management is to minimize the losses incurred on foreign exchanges, cash volatility and in turn increase profit, steady earnings and sustainability of the organization (Fatemi & Glaum, 2000). Although there are several procedures and models that can be employed to management risks as defined by regulators, still many firms failed to adopt well defined strategies (Bessis, 2010; Pyle, 1997). For instance, Société Générale bank had suffered USD7.2 billion losses due to illegal actions involved by an employee. Therefore, the management flaws, inefficient controls and systems along with errors, illegal activities contribute to operational risk as pointed by Crouhy et al. (2006). It is therefore significant for banks to formulate such suitable and innovative methods on the basis of risk profile of customers.

Background of the study

The financial progression of a country is attributed to the growth in its economy (Levine & Zervos, 1998; Aghion et al., 2005), while the economic developments of an upcoming country like Nigeria rests on its banking sector. On its regression, it poses a detrimental effect on bank’s growth in turn reflecting on the country’s entire economy (Owojori et al., 2011). At present, crisis control is the key word that is used in banking sector (Rahman et al., 2004; Atikogullari, 2009) in order to gauge the adaptability in times of crisis (Ozyildirim & Ozdincer, 2008). In Nigeria, banks often take excessive risks and according to the report by The FDIC (2010) stated a total of 168 banks have been shutdown with the time period of 2007 to 2009. By understanding the present scenario, the Central Bank of Nigeria (CBN) introduces measures that stable bank’s environment to sustain public confidence (The Obasanjo Economic Reforms on the Banking sector, 2005). Tremendous progression were found in Nigerian banks that lend itself to privatize and liberalize that was associated with quality, quantity, merger and acquisitions, latest technology and expansion (Owojori et al., 2011). Perhaps this is the compelling reason to seriously consider the risk management issues including financial/credit, operational, reputation, human resource, as a sustainable competitive advantage (Appa, 1996).

Statement of the Problem

The performance based on bank’s ownership has not been evaluated much earlier (Sathe, 2003). Few studies have indicated that either the entire or partial bank privatization has enhanced the performance while other studies pointed out that privatized banks fair better than its private counterparts. In the beginning of 1990’s there was a tremendous impact of the deregulatory effect of Nigerian Banks. Thus, liberalization of banking changed the patterns of competitive advantage in the industry particularly many banks have reengineered their operations to enhance their service and performance to sustain and remain competitively in the industry (Aregebeyen, 2011). The Nigerian banking sector pointed out a restricted growth in Non-Performing Assets (NPAs) (Owojori et al., 2011; Ibrahim et al., 2012) owing to the conditions of high growth in Gross Domestic Product (GDP), banks size and maturity. Non-performing Assets (NPA)s are also influenced by an efficient foreign exchange rate and effective growth in GDP. Previous studies have established the significant parameters to be followed for a risk management process in a firm (Tchankova 2002, Kromschroder & Luck, 1998, Barton et al. 2002). In addition, the study by Al-Tamimi and Al-Mazrooei (2007) stated that apart from Nigeria almost most of the counties have enumerated the risk management method. Based on these studies, the present research is conceived to define based on the highlights of Al-Tamimi and Al-Mazrooei (2007).

There are many studies and reports related to risk management of financial sectors in Nigeria. Further, previous studies conducted on risk management strategies in Nigeria have focused on single measures of risk such as liquidity or credit risks in commercial banks (Aliyu, 2010; Adebayo, 2010Owojori et al., 2011; Aregebeyen, 2011; Ibrahim et al., 2012;). However, most of the studies are dealt with risk management and their practices in countries like UAE (Al-Tamini & Al-Mazrooei, 2007; Al-Tamimi, 2008), Middle East (Hassan, 2011), Bahrain (Abu Hussain &A-Ajmi, 2012), Bangladesh (Alam & Masukujjaman, 2011), Brunei Darussalam (Hassan, 2009), Pakistan (Khalid & Amjad, 2012; Nazir et al., 2012). But, to our knowledge none of these studies focused on creating sustainable competitive advantage by using these practices in Nigerian banks. Therefore, present study would shed light on the risk that bankers faced and how such risks are managed as well as those risks associated with consolidation by providing empirical data.

Research Aim

The present study aimed to examine whether risks management practices implemented by commercial banks in Nigeria create sustained competitive advantage.

Research Objectives

The research objectives are:

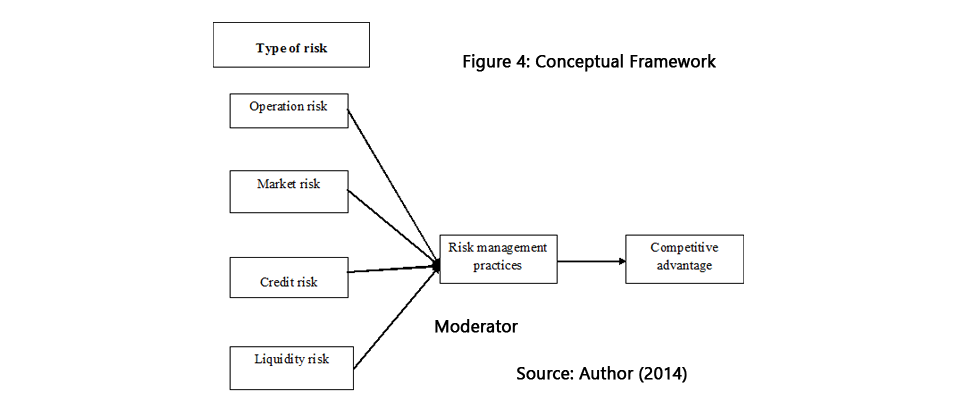

- To identify the frequency and quantification of the type of risks being monitored by Commercial banks in Nigeria

- To examine the relationship of different type of risk experienced by Nigerian Commercial Bank namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage

- To examine the relationship of different risk management practices adopted by Nigerian Commercial Bank namely (a) risk identification (b) risk understanding (c) monitoring and evaluation (d) and Competitive Advantage

- To examine whether the relationship of different type of risk namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage is moderated by risk management practices adopted by Nigerian Commercial banks

- Research Hypotheses

Based on the review and formulation of objectives the following research hypothesis (convectional-alternative) is proposed. The research hypotheses are:

H1: There is a significant relationship among the different type of risk experienced by Nigerian Commercial Bank namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage.

H2: There is a significant association among the type of risk and Competitive Advantage

H3: There is a significant relationship between risk management practices namely: analysis, risk identification, understanding and monitoring and competitive Advantage.

H4: The significant relationship between different type of risk namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage is moderated by risk management practices adopted by Nigerian Commercial banks

Research Methodology

The present study was employed descriptive design, which involves acquisition of data on recent trend of the scenario in order to examine the effect of type of risk and Competitive Advantage when moderating variable of risk management practices are involved in Nigeria commercial banks. In the present study quantitative data collection (Saunders et al., 2009) was used to collect the primary data. Nigeria was chosen for the study owing to the rapid growth of banking sectors (Owojori et al., 2011). The current study view the initiation of reforms in banking sectors in order to enable the inclusion of banking loans as part of the study. In Nigeria, 72 bank officers were identified from 23 commercial banks in two specific regions such as Eastern and Western regions of Nigeria using purposive sampling method. Questionnaire was used as a survey instrument to obtain data from the divisional level management, board of directors, branch level experts, executive committee and audit committee. Initially, Pilot study was conducted with 10 participants from the target population in order to ensure reliability of the questionnaire. Various tests were carried out such as Chi-square test, regression and Pearson correlation to analyze the obtained data.

Significance of the Study

The information provided from the present study includes the assessment and best techniques which are proposed for risk management in commercial banks. The adaptability and restraining capacity of the banking sector to the crisis were investigated in the study. In addition, deviations from international best practices were also identified and alternatives were recommended. The bank‘s ability to deal with significant shocks and avoid losses during crisis periods was also tested.

Scope and Limitation of the Study

This study tends to identify the effectiveness of risk management and its practices in the commercial bank of Nigeria through questionnaire design only. Due to limited However, financial documents and annual reports were limited to only three years (2009 to 2012) of the banking industry. Although the present study is based on cross sectional design which helps to gather large sample size within a short period of time but it limits in cause and effect relationship. Hence, in order to avoid the cause and effect relationship, future study should focus on longitudinal nature.

Organization of the Study

This investigative process is structured into six chapters namely:

First chapter: Introduction - This section contains background of the study, aim, objectives, and statement of the problem, proposed methodology, scope and significance of the study.

Second Chapter:Literature Review- This chapter reviews the previous studies on risk management in commercial banks. Moreover, this section also discusses about the existing research gap and theoretical framework.

Third Chapter: Research Methodology- This chapter discusses about adopted research strategy, research approach, research philosophy, sampling technique and method of data collection method in detail. It also contains the sample size, target area and target population.

Fourth Chapter: Findings- This chapter explains about the usage of Descriptive statistics, Demographic characteristics of sample, sample test, Regression and Correlation analysis.

Fifth chapter: Discussion and Conclusion: This chapter explains about the study result which is observed from chapter IV (findings) and give conclusion with facts inferred from the results. This section suggests propositions based on the analysis for risk management

First chapter: Introduction - This section contains background of the study, aim, objectives, and statement of the problem, proposed methodology, scope and significance of the study.

First chapter: Introduction - This section contains background of the study, aim, objectives, and statement of the problem, proposed methodology, scope and significance of the study.

CHAPTER II: LITERATURE REVIEW

Introduction

In the growing complexity of the banks, business and dynamic operating environment, the risk management plays an important role with special reference to financial sector. Financial progression is an important factor in developing the economic condition of the country (Levine & Zervos, 1998; Aghion et al., 2005). On the other hand, economic growth is considerably depends on its banking sector. Given this scenario, the current chapter introduced literature review on the risk management concept in order to establish competitive benefits for bank particularly to attain sustainable earnings. To assess the periodicals, the proquest documentation as well as different other data sources, including Emerald database, Google Scholar, Science Direct, SAGE magazines as well as other documented information (for instance Global assessment of Investment) were utilized. The data was accessed based on peer reviewed articles between 2005 and 2013 using basic search terms, concentrating on terms such as 'risk', 'risk management', ‘banks’, ‘competitiveness’ ‘competitive advantage’ in addition to predominantly concentrate on the ‘Nigerian’ setting. Additionally, different types of risk such as legal, operational, credit, liquidity and market risks are also comprehensively discussed in the present section. Political system, macro economics and IT are the risks that affects bank sustainable earning also analyzed. Moreover, quantification associates with risk management process are also examined in this chapter. In addition to the previous risk management studies, risk management factors which affecting several countries with special reference to Nigeria were also focused in the current chapter. Finally, this chapter focuses on how risk management practices aid to achieve the competitive advantage via competitive strategy and resource view were also discussed.

Concepts and Definitions

Risk and Risk management

Risk means any hindrances in the process of achievement, which might be due to internal or external factors. At any circumstances, it is impossible to evade risk, as it exists in everyday life, whether at work or at home. Risk when considering fiscal circumstances, is generally depicted as the possibility where the real yields might differ from the projected profits (Howells & Bain, 1999, p. 30). In the financial system, one can witness three broad categories of risks such as: (i) financial risks; (ii) business risks (iii) operational risks (Khan, 2006, p.5). Monetary risks also connected to the dangers imminent from investment procedures, whereas business risks as well as operational risks are connected to the central transactions of the banking sector. Pertaining to this, assets risk is classified in the financial risk group along with marketplace risks as well as credit risk. The subsequent section describes the risk management and its regulation.

Risk management and Regulation

Risk Management is a measure that is used for identifying, analyzing and responding to that particular risk. It is a process that is continuous in nature and serves as a tool in decision making process. Risk management is depicted as a method to decrease the impact of uncertainty formed owing to penalty, (Roth & Schmit, 1990) additionally approach comprises records, rough calculation as well as regulation of the risk (Rejda, 1998). The important intent of risk management is to decrease the foreign dispute penalties, reduce the volatility of money variation, lessen proceeds uncertainties, augment cost-efficiency, and further protect continued existence of the business (Fatemi & Glaum, 2000) and there are tools and methods to assess and regulate risk control (Bessis, 2010). The risk management procedure confirms that imminent risks are within the limits stipulated by the controllers (Pyle, 1997). Thus, banks have to provide strategies to take the initiative to ensure the appropriate formulation strategies founded on users’ risk profile. The related aspects of bank risk management methods can be defined and stated as follows (Faulkner & Bowman, 2000; Soviani, 2003; Bărbulescu et al., 2002; Lewis et al., 1995):

- It arranges, offers and develops the best accessible records on risk;

- Permits administration judgments, to usually assist the connection between workers, controllers and the community when considering the type of risk and its regulation;

- It is a sustained and comprehensive process of the management;

- It requires a high level of dedication from managerial and higher authority.

- It includes the credentials, examination and group of risks’ substitute regulatory methods, and the assessment of performance measures;

- It includes the risk inquiry, documentation and identification;

- It gives the likelihood to design “the way” in order to attain the fixed purposes;

- It requires sufficient information;

- It develop rationally, obtain uniformity, records and interprets the method of select, as per doubts and advantages, between comparable options;

- It should insure the whole gamut of intimidation and risks;

- The risk management difficulties are organized, but flexible; they contain performance approximation and request controlling, ensuing and relating incident of developments, bearing in mind the anticipated outcomes.

The implementation of risk management is not a reaction to risk, rather an organizational prototype which comprise of changes in the method of banking business (IFAC, 1999), strengthens, assigns responsibilities, as well as renders risk management a basic capability, persistently and at the precise time harnesses the risk directive. Thus , risk management must be a basic segment of the bank administration, motivating functional effectiveness rather than system of management, by vigorously examining the cost/benefit proportions generated by the response to risks. The following section briefly explains about the risk management with special reference to banking sector.

Risk managements in Banks

The major focus of management of bank is to increase the expected profit taking in to account its variability (risk). Thus, the risk management is an attempt to reduce the variability of profit so as to decrease the value of the shareholders wealth. After the cruel financial crisis of 2008, the concept of risk management has taken a new form. According to González-Páramo (2011), Member of the Executive Board of the ECB, the key question is whether the shift in attitude towards risk has changed only as a result of the materialization of some ‘forgotten’ risks or whether there is a deeper and more structural explanation for the shift. Further members stated that the shift of attitude of academics, public and market participants in assessing the risk related issues is not only due to the severity of crisis but also its uncertainty on financial and economic system. In addition to this, the financial crisis is also related to both administration and management.

The majority of the research embracing the field of risk management has been skewed in the direction of study and improvement of models for evaluating the risk and other paramount parts of risk management which is frequently remains ignored. Underlining the vitality of different parts of risk management and highlighting its shortcomings of measurable risk quantification models, Strebel and Lu (2010) revealed that the risk management at the highest point of organizations, particularly fiscal firms, is not about workstation displaying; it’s about official judgment. This recommends that board members not only should have financial expertise to recognise the risk but it is also necessary to raise the correct question so as to avoid chairman or CEO becoming dominant. Even firms with refined PC models could be headed adrift when they neglect to acclimatize their underlying presumptions towards the evolving conditions.

Schmit and Roth (1990) adopted the procedures to minimize the results of the impact of risk which is termed risk management (Redja, 1998). Analysis, recognition and legislation are the three techniques adopted in order to reduce the risks. The primary point of risk management is to minimize the risk that occurs due to remote trades, money liquidity, and increment of, unstable income and supportability of the association (Fatemi & Glaum, 2000). Bessis (2010) study focused on gain entrance and overcomes money related risks, certain models and instruments might be utilized. Pyle (1997) includes the methodology with utmost possible risk characters which were considered as risk management. It is along these lines significant for banks to define such suitable and imaginative strategies on the groundwork of risk profile of clients. The following section focused on the classification of risk in relation to the banking sector.

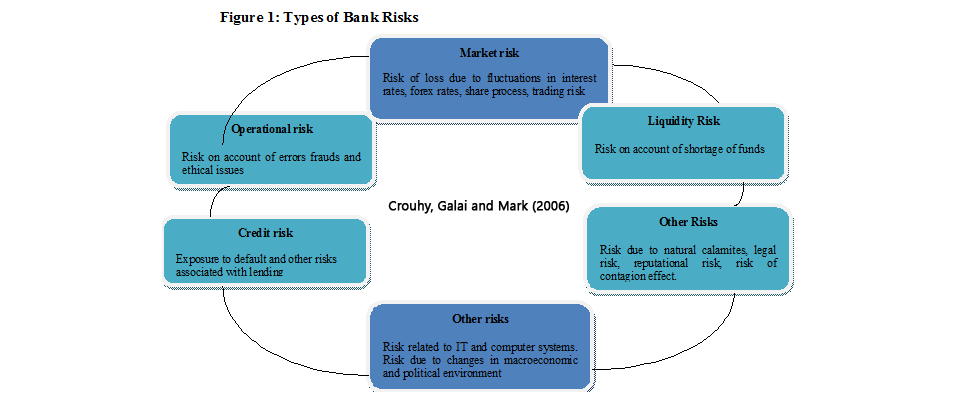

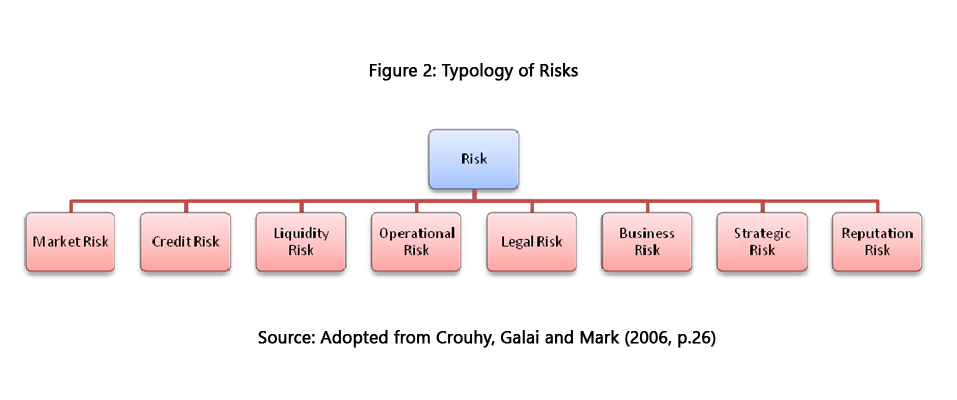

Classification of Risks in Banking

Previous researchers and financial analysts have attempted to classify the risk in banking. Basel Committee has indicated that market, operational and Credit risk has been obtained from one category whereas other risk is acquired from additional category. Santomero (1997) has illustrated the classification of risk by using service types such as counterparty risk, systematic risk, liquidity risk, market risk, credit risk, (interest rate risk), legal risks and operational risk (The Wharton Financial Institutions Center, 1997). As per Bratanovic and Greuning, three major classifications have been illustrated and tabulated in table 1.

Table 1: Different types of Banking Risks

| Financial Risk | Operational Risk | Environmental Risk |

|---|---|---|

| Balance Sheet Structure | Internal Fraud | Country and Political Risks |

| Earnings and Income statement structure | External Fraud | Macroeconomic policy |

| Capital Adequacy | Employment practices and work place safety | Financial Infrastructure |

| Credit | Clients, products and business services | Legal Infrastructure |

| Liquidity | Damage to Physical assets | Banking crisis and contagion |

| Market | Business disruption and system failures (Technology risks) |

Credit Risk

Credit risk arises when other side of business contract is not willing to implement the given task. The impact of this risk is evaluated in expenditures required to remunerate the defaults. According to Bessis (1998) the credit risk may be portrayed as the unpredictable activities, which includes external impact, loose compensation and liability defaults. Credit risk plays a major role in banks in order to determine the organization's capacity to fulfil its financial commitments (Boguslauskas & Mileris, 2010).

Liquidity risk

The necessity of liquidity in banks is illustrated in the study conducted by Greuning and Bratanovic (2009) as it compensate for expected and unexpected balance sheet fluctuations and funds for growth. According to Bessis (2010) liquid risk arises as a result of difficulties in raising funds, perhaps liquidity serves as a safety cushion which helps the bank to gain time under difficult situation. The liquidity risk is considered as extreme situation where a loss creates liquidity issue which doubts the future of the bank.

Operational risk

The operational risk is defined as the “prerequisite for the theoretical analysis of a problem” (Lopez, 2002). As per the British Bankers Association (BBA) “Operational risk is the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems or from external events.” Croupy et al. (2001), Lopez (2002) and Schroeck (2002) employed a similar method to state the operational risk, since the risk arise both internally and externally. The risk that arises from external events may contain various uncontrollable factors, like terrorism attack, natural disaster which may damage the properties of bank and results in business loss. Lopez (2002) illustrated that internal processes would be attached closely to a certain products of organization and business lines; therefore they have to be more specific about the risks that occur due to the external events.

Market risk

The market-risk and market price can be recognised in sensitive financial instrument like stocks, currency exchange deals, exchange market objects, interest rates-related financial instruments, and several derivatives. The type of risk is used to while categorizing the market risk into sub sections (Kancerevyčius, 2004; Vaškelaitis, 2003; Dzikevičius, 2003) such as exchange market’s prices’ risk, foreign currency rates’ risk, interest rates’ risk and stock prices’ risk. Pyle (1997) stated that market risk vary in net asset value which might be due to its change in the economic attributes like interest and exchange rates, and commodity and equity prices. Generally, in banks there are three common market risk factors such as foreign exchange rates, interest rates and liquidity. The following section focused on the previous empirical studies which focused on the risk management.

Previous Empirical Studies

Risk management techniques utilised to attain firm’s value can also been confirmed through empirical research. Similarly, to other business banking sector also faced the banking risk. According to Basel II, the Basel committee on banking supervision, three types of risk were identified in banking sector, which includes credited risk, operational risk and the market risk (Global Association of Risk Professional, 2009 ). Toby (2005) analyzed the lack of liquidity through optimal cash flow management rehearses inside a risks return structure in Nigerian-Manufacturing ventures. The findings revealed that the respondents are unequipped for interacting with the financial market particularly throughout irregular macroeconomic environment and consequently need to redefine their banking relationships. In a another study assessed the significance of treasury objectives like incidence of treasury risk in bank portfolio management, causes of asset-liability mismatch in banks and causes of liquidity crisis (Tobby, 2006). Notwithstanding, the discoveries demonstrated that most banks falls some place between acquired liquidity proportions of the chosen banks and their ideas don't describe sequencing of asset for transfer in anticipation of different degrees or intensities of deposits/fund withdrawals. Thus from the findings of these studies it is infers that the risk systems used in the Nigerian banks are not as expected and if this continuous to occur, there is a plausibility of bank run which could finally drive a bank into bankruptcy.

Earlier, the performance has not been evaluated based on bank’s ownership (Sathe, 2003). Later, certain studies have illustrated that either whole or partial bank privatization has upgraded the performance whereas additional studies indicates that privatized banks is better than private counterparts. The banking sectors of Nigeria demonstrate a confined development in Non-Performing Asset (NPAs) (Owojori et al., 2011; Ibrahim et al., 2012) owing to the condition of high development in banks size, maturity and GDP. With the help of effective growth in GDP and efficient foreign exchange rate, NPA is influenced. Certain analysis identifies risk management strategies which are utilized in several countries other than Nigeria (e.g. Al-Tamimi & Al-Mazrooei, 2007).

The inspiration of risk management practises were originates from the risk of certain bank’s which was underperformed. These banks has comes across various risk factors such as credit risk, interest risk, operational and technology risk, market risk, off balance risk, liquidity risk, foreign exchange risk, insolvency risk and country risk. Economic growth and banks has a greater impact on banking sector due to the issues related to risk management. Cebenyoan and Strahan (2004) presumes that some experimental proof shows that the previous return stocks originate from banking sector have important effect on the aggregate stock markets and foreign exchange as well as on their prices indicating bank have great impact during financial crisis.

Banks which better execute the risk management may have a few points of interest: (i) It is in accordance with dutifulness capacity around the standard; (ii) It enhance their reputation and chance to pull all the wide clients into building their portfolio of store assets; (iii) It builds their productivity and benefit. The banks which are progressed in risk management have more excellent credit accessibility, instead of decreased risk in the bank profit (Cebenyoan and Strahan, 2004). The more amazing credit accessibility accelerates the chance to expand the beneficial possessions and bank's benefit. Bonin (2003) pointed out that a general strategy for stabilize the banking sector is by preventing banks from taking part in high risk through compelling them to offer store and buy credit. However, study by Good hart et al. (1998) include that the ordinary technique tends to advances the risks to survey delegates, check their credit approach and confirm that they have sufficient supports as a cradle against reprobate credits. Hooks (2004) encourage controllers to requirement bank venture prospects to particular credit commendable aggregations utilizing corporate influence through risk management department maintaining the effective risk rule and practices.

As per the investigation of Spollen (2007) in control and risk management posited that organizations ought to be attentive to the need of controlling a sound risk management where credit manager/head offers item to the directorate and likewise verify the presence and consistence levels of risk control. According to Sanusi (2010), banking is not only for lending and deposit mobilization but also to other assets and maintaining the loans produced from pool of deposits. Further study proposed that the banking has to focus on the strategic placement of fund and risk analysis so as to increase the maximum earnings at minimum risk. Thus, chief risk officers who account straight to the board via CEO/Managing director have to involve in the competent service.

. Sustainable Competitive advantage for Sustainable Earnings

The competitive advantage will be meaningful only if it is felt in the marketplace and the differentiation must be perceived as an important buying criterion to a substantial customer base. The sustainable competitive advantage is the unique position where the organization has to develop in relation to their competitors which allows the organization to outperform consistently.Sustainable competitive advantage can be built up over a period of time based upon some unique competencies. Based on the knowledge, know-how, experience, innovation, and unique information use (Lowson, 2002 ). Therefore, such advantage will be sustainable, only if it cannot be imitated (Barney, 1991 ).

Risk management is a definitive aggressive point of interest which is possible to serve in order to uphold the steadiness, progression, backings income and profit development. An organisation which is focusing on the preference may encounter solid tests in its industry as it endeavours to remain deliberately aggressive. Previous studies have investigated such conditions were the business‟ aggressive point of interest is practical (Barney, 1991; Coyne 1985). There are two integral models of intense preference, namely, market base model and company resource model; both models are grounded in financial hypothesis (see Conner, 1991; Porter, 2001, 1985). The market-based model is the primary model which focused on the differentiation and cost and also argues that the environment chooses company which is not efficient as well as does not produce products to client is ready to pay a premium cost. External factors are the major elements to determine the benefits of this model(industry competition, threats and opportunities) and, as Porter (1985) focuses out, supporting leeway methods giving contenders ``a moving focus on.'' The second model focuses on the company's resources and carried out by the internal factors of the firm. Idiosyncratic resources offer operational predominance or assistance make a better market position permit the firm than create predominant returns. In this asset based on hypothesis model, maintainability of focal point depends upon contenders not having the ability to mirror assets. Porter (1998 ) posited that a public university may obtain a competitive advantage by creating a higher value for its customers than the cost of creating it, either by adopting a differentiation strategy or an efficiency strategy. Resources incorporate “capabilities, assets, organizational processes, information, knowledge and firm attributes,'' and could be characterized by regarding human, organizational capital and physical (Barney, 1991, p. 101). Organizational and human capital are the principle drivers of competitive benefits, whereas physical capital, are not obtained easily in the market factor. Wernerfelt and Hansen (1989) identified that the organizational variables demonstrated twice to the extent that in execution as economic factor. Whereas Powell (1992) debated that the management abilities were utilised to adjust the association to its surroundings are assets that might be source of benefits. Hall (1992, 1993) suggested that the ``lasting and predominant nature of immaterial assets'' (for instance, representative capacity, capability to oversee change) are sustainable benefits sources, Similarly, Pfeffer (1994, 1995) distinguishes individuals, their abilities, and the way they are overseen as being paramount.

Mondal and Ghosh (2012) investigated the relationship between intellectual capital and financial performance of the Indian bank. The findings concluded that the relationship between the performance of the banks, the intellectual and financial indicators are varied. In addition, this study also reveals that the intellectual capital plays an important role in the bank’s competitive advantage. Kaplan and Norton (2011 ) introduced the balanced score card as a more realistic measure of performance. The key items linked are financials, customer service and satisfaction index, learning and growth within the organization and internal business processes. Internal business process is the path to achieving strong financial results and superior customer satisfaction. Pearce and Robinson (2003) highlight three economic goals, which define a company’s performance guided by strategic direction. These goals are survival in the market, growth and profitability.

Gloria and Ding (2005) investigated the mediating effects of a firm’s competitive strategy in the market orientation-performance relationship. Gathoga (2011) focused on competitive strategies by commercial banks in Kenya. The study revealed that banks used various methods to maintain the competitiveness. Further the study concluded that the expansion of the banks to other areas by opening new branches has also, been used as a strategy. Wilson and Lado (1994, p. 699) suggested that the human resource frameworks is more significant since they are “firm particular, provide the complex social relationships, are installed in the company's culture and history, furthermore create inferred organizational learning”.' Further the asserts such as social assets, organizational aptitudes, and powerful top administration were subordinate and are created (Helfat and Castanias 1991;; Collis, 1991; Williams, 1992; Mahoney, 1995). Heterogeneity around firms' organizational and human resource is at the centre of the resource-based perspective of aggressive point of interest. Barney's (1991) termed that, resources has to be valuable as well as rare, and if benefit has to remain after limited term then it should be imperfectly mobile (i.e., competitors cannot acquired easily on the open market). These contentions expect that there are ex risk and ex post points of confinement to rivalry for rents (Peteraf, 1993). The leading suspicion suggests data asymmetry; generally, leases might be offered away by opponents who understood the correct quality of the assets. The second suspicion presupposes the presence of restraints to copy.

In spite of the fact that a few contrasts exist around conceptualizations of hindrances to impersonation, there is additionally considerable cover (Bharadwaj et al., 1993). For instance, Cool and Dierickx (1989) contend that mannerisms in the way that firms gather resource make impersonation critical, and Rumelt's (1984) “isolating instruments'' and Coyne's (1985) ``gaps'' are the ideas used to manage the asymmetries between firms' resources. The fundamental territory of cover and the most-concurred upon excuse for why copy might be challenging is causal vagueness between business outputs and inputs. Defillippi and Reed (1990) debated that complexity and tacitness provide causal uncertainty and, along these lines, restraints to imitation. Implied activity is experience-based and emerges from taking in by-doing. Intricacy emerges from the interrelationship around assets. It has been contended that process and strategy content ought to be acknowledged together (Barney & Zajac, 1994; Mahoney, 1995; Schendel, 1994). At the same time, as could be found from Collis (1991), the market based view of benefits most promptly fits the dissection of strategy content. Also, from Lado and Wilson (1994), it could be reasoned that the resource based view more promptly fits into issues of strategy process. Thus, to accompany exchanges, we utilize the market-based view as the major method for recognizing the part that RM practices can play in creating leverage and the resource based perspective for tending to the inquiry of maintainability. On account of the recent, our contentions likewise draw upon frameworks hypothesis. The concept of risk management practices as a competitive advantage will briefly discussed in the following section.

Risk management practices as a competitive advantage

In the present scenario the large portions of the risk management issues confronted by banks might be interfaced to the impacts of globalization and deregulation. The liberalization of premium rate controls, the privatization of publicly claimed banks, and the extension on the category of financial instruments, furnished new business chances for banks. In addition they expanded the requirement for fitting risk management frameworks set up keeping in mind the end goal to control the risks and doubts determining from these progressions.

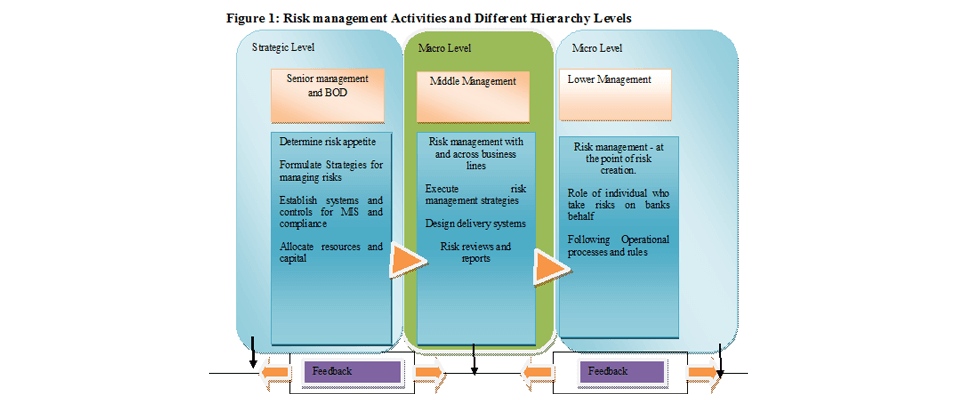

As Penza and Bansal (2001) pointed out, the Basel Capital Accord of 1988 was the first stage towards risk management. This accord secured least capital necessities to be utilized by business banks keeping in mind the end goal to secure against credit risks. The accord was changed in 1996 to fuse business risk, and at last in June 1999, the Basel Committee proposed another accord reputed to be Basel II to reinstate the 1988 Accord. Presently, the vast majority of the banks are currently embracing Basel II principles with respect to their promotions. Making utilization of these complex risk management systems, be that as it may, obliges banks to grasp a risk management society and advance the important organizational structures that will permit them to utilize these methods adequately. Reserve Bank of Australia demonstrated the clear formation of banking organisation. Around the bank department, the Risk Management Department has a unique area in the banks' association structure. Given the mixture of risks that banks are presented to, it is consistent to have a divide and autonomous Risk Management Department (Basel Committee on Banks Supervision, 2001).

The Board of Directors (BOD) that lies at the highest point of any banking association sets the bank's technique and goals, and additionally answerable for setting the risk presentation points of confinement of the bank, destinations, and is likewise answerable for setting the risk presentation breaking points of the bank. In other words, BOD is considered as leading risk administrator of a bank. It is the form that might as well set the bank's strategies. The General Manager or Chief Executive Officer (CEO) is answerable for actualizing the approaches set by the BOD. The Audit panel of the BOD is typically connected to both the BOD and the CEO and it is an expansion of the BOD risk management capacity. This council has a definitive control over the Internal Audit branches, Internal Control and Risk Management (Van Greuning & Bratanovic, 2003). Global encounters prescribe that the audit function, internal control, and risk management be composed into different units in a business bank. In view of these studies, the present research is formulated to characterize dependent upon the highlights of Al-Tamimi and Al-Mazrooei (2007). The accompanying goals are authored dependent upon this base.

Key success factors and Competitive Advantage in the Banking Industry

The critical success factors is one of the accepted methods which rely on the factor analysis techniques for corporate strategic planning, which aims to examine the factor structures present in a set of variables. As per Sureshchandar et al. (2002), factor analysis determines relatively small number of factors that illustrates the association among a set of interrelated variables.

Critical success factors rely on the purpose and methods for which they were utilised (Fung, 2006). In banking industry Chen (1999) originates four critical success factors such as ability of bank operation management, establishing bank trademarks, bank marketing and financial market management. It reflects as four business goals for the commercial bank manager. In financial service firm, reputation was recognized as both competitive advantage and entry barrier (Fung, 2006).

Now-a-days, operational risks helps to enhance the process effectiveness, support better communication and controlling external risks like regulatory and reputation risk (Denayer, 2004). Moreover, operational risk management can facilitate competitive advantage as well as minimize the negative results. Young and Theodore (2003) determined the sound operational risk management may also affect organizational reputation, share prices and credit rating. Analyst and investor pay more attention with respect to the strategy, their measurement of management and the expected long-term business performance. Ultimately, the advantage of proactive operational risk management may lead to lower costs and greater efficiencies for lending money therefore enable an organization to attain competitive advantage (Fung, 2006).

Nigerian Banking System: Risk Management Scenario

As the banks have began to follow a new way of performing business, there are concerns revolving around it with respect to the amount of sustainability on the principles it follows even after the present Governor leaves the chair. The major sources of uncertainty based on the Nigerian business environment which helps in reversing the business principles if it is not under perusal of Governor of Central Bank. Similarly, sustainable banking followed in this region might be abandoned and this uncertainty is already included as principally risk management measures in narrow portrayal principle. In addition, there is a risk of uncompetitive market firms that includes even the Nigerian banks that also has a sustainable agenda.

Referring to an example in Nigeria, Orogun in 2009 cited that the failure of banks in Nigeria is due to various factors. The factors such as inappropriate capital as its base, frauds, self-service and practices of corruption exercised by the owners or managers along with the unwanted interference of members of the board in the everyday activities of the bank affected its operations and regulation. Apart from this, in 2012 the theory was made by Offiong and Ewa stated that the best management equity interest has an influence in the financial disclosure levels and the measures of transparency by Audit Committee were not effective. It also stated it was not free from the interference of managers, board members, bank owners and other such individuals, which made it lose its expertise.

Ezeoha (2011 ) identified the major determinants of the bank in the regulation of induced banking environment. The findings revealed that the in Nigerian banking industry the deterioration in asset quality and increased credit crisis was exacerbated by the inability of banks to optimally use their big asset capacity to enhance their earnings profiles. Thus, the excess liquidity and large capital bases fuelled the frequent lending by banks, which leads to unsecured credits in banks' portfolios. It is well known that the attitude of the Nigerian banks’ adaptive to new principles and sustainable practices are also considered with same effect. The business community always opines that there must be a sense of commitment to follow a sustainable strategy that features an activity set, as it is powerful yet attractive. These strategies can help banks to manage all risks single handed, find more opportunities and adapt well to business concepts. However, in the point of corporate commitment strategy must be sustainable in the long run. This is because it helps the firms to lower the negative impact and increase positive impact on different kind of shareholders such as customers, local communities, employees, Governments and unions. This way there would be an equal winning strategy for both the society as well as the business.

When considering this aspect, the sustainability commitment would not be a main strategy but it would offer an idea of how the strategy is designed and developed, during the strategy formulation. To make a trusted and sustainable commitment, it is essential that the society has to provide enough environments for it to thrive well. However, considering the Nigerian business environment, it has poor way of governance similar to other markets of developing countries that have low consumer voice and these have slowly led to the growth or failure of the sustainable banking principles in Nigeria. Thus many changes are required to take this forward and create a sustainable environment, the banks have to embrace sustainability with open arms to enjoy the desired change in its sector that benefits in the long run and prevent them falling low as victims of weaker institutions (Amaeshi & Ogbechie, 2013).

Research Gap and Summary

Majority of the study has focused on the risk management and focused on (Kwan & Eisenbis, 1997; Berger & DeYoung, 1997) type of risks on holistic perspective. Further, the risk management practices are from countries like UAE (Al-Tamini & Al-Mazrooei, 2007; Al-Tamimi, 2008), Middle East (Hassan, 2011), Bahrain (Abu Hussain & A-Ajmi, 2012), Bangladesh (Alam & Masukujjaman, 2011), Brunei Darussalam (Hassan, 2009), Pakistan (Khalid & Amjad, 2012; Nazir et al., 2012). However, all these studies focused on the risk management and their practices but not to our knowledge none from whether these practices create sustainable competitive advantage. Previous studies have almost focused on risk supervision techniques in financial institutions. Although there are previous studies focused on risk management, there is a paucity of studies in Nigerian Banking sector. Thus, the present research aims to minimise the risk in functional and broad, market, assets, and credit risk supervision in specific and identified whether these risk management practices provide competitive advantage to banks. Hence, with respective to these gaps, the research implemented the theoretical framework which has been recognised in this chapter.

Theoretical Framework

In this conceptual framework, type of risk is considered as the independent variables in banking industry. There are several types of risk in a bank that directs the bank to attain competitive advantage against its competitor. In this study, liquidity risk, credit risk, operation risk and market risk were perceived as sources of competitive benefits in banking industry. Competitive advantage is taken as dependent variable in this study. In the present study, it was perceived that operation risk, market risk, credit risk and liquidity risk is considered as the independent variable in banking industry which would enhance the bank in order to attain competitive advantage (dependent variable).

CHAPTER III: RESEARCH METHODOLOGY

Introduction

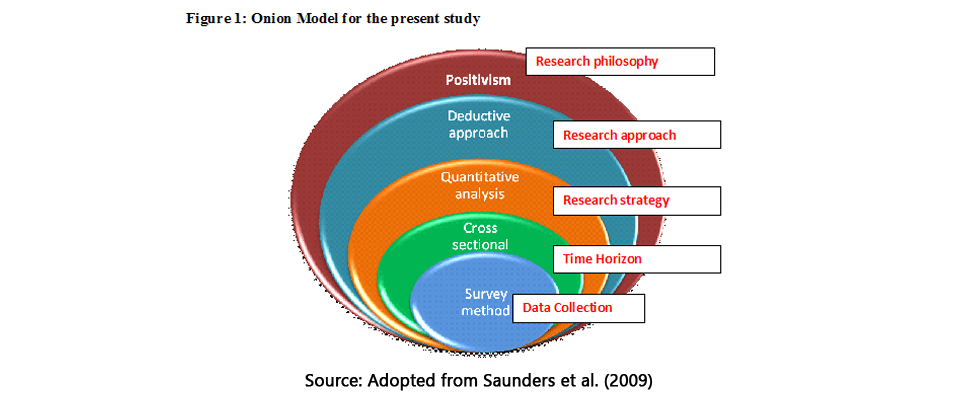

The research methodology is considered as blueprint of a research study which encompasses several research activities, description of procedures, formulations to access the growth and development and various other success-related factors. This enables to evaluate and assess the collected data, research methodology acts as a reference outline in order to make sure that the collection and evaluation of the collected information is appropriate to achieve the objective of the present study (Sekaran, 2003). The ultimate objective of the study is to scrutinize and validate the risk management methodologies in the commercial investment firms and banks of Nigeria. In addition study also determines its function in accomplishing competitive gain. This chapter explains briefly about the research strategy, research approach, research philosophy, sampling methods, sample size, and data collection techniques and also tests for both reliability and validity using Onion framework proposed by Saunders et al. (2009). The present study has adopted quantitative research techniques which help to determine whether risk management approaches would enable in fulfilling their objectives.

Research Design

Cooper and Schindler (2003) cited that methodological enquiry is a significant aspect that is required in any business research. There are three distinctive types of research studies which includes Exploratory, Descriptive and Explanatory. The present study descriptive research design is applied since the research questions are imposed to estimate the trends and orientation on a large scale and analyse on certain factors emerging within the studies. Such an implementation contributes itself better to descriptive research methodology. The research questions which are responded through the descriptive research methodology are considered as exclusively illustrative in nature and are answered with the help of literature review. Furthermore, descriptive research approach necessitates pragmatic confirmations to figure out the problems and disadvantages of literature and to ascertain a hypothetical framework.

“Onion” research model developed by Saunders et al. (2003) is employed in the present study. As per the “Onion” framework, 5 different layers are applicable to any type of research deign. Table 1 illustrates the five layers of “Onion” model.

Table 2: Onion model framework

| Layer | Approaches |

|---|---|

| Research philosophy | Realism |

| Research approaches | Deductive, Inductive |

| Research strategies | Experiment, Survey, Case study, Grounded theory, Ethnography, Action research |

| Time horizons | Cross Sectional, Longitudinal |

| Data collection methods | Sampling, Secondary data, Observation, Interviews, Questionnaires |

Source: Adopted from Saunders et al., (2003)

Research Philosophy

The word “research philosophy” indicates the method adopted to gather, analyze and use the data. There are three types of research philosophy they are: Positivism, Interpretivism and Realism.

Positivism

Positivism depends on truth, value of reason and validity and it also focus merely on facts, collected via direct observation and evaluate and experience empirically through quantitative methods like experiments and surveys and statistical analysis (Saunders et al., 2007; Eriksson & Kovalainen, 2008).

Interpretivism

As per the Blaikie (1993) interpretivism is considered as post-positivist, whereas, Hatch and Cunliffe (2006) consider as anti-positivist. This research philosophy is used when one considers the actual reality in a research environment.

Realism

As per this philosophy, reality is independent of beliefs or thoughts which can be utilised to same type of situation. Hence both positivism and interpretivism are involved in this philosophy (Saunders et al., 2003).

The present study adopts positivism which determines the risk type experienced in commercial banks.

Justification for the chosen Philosophy

The present study guides through positivism since it gathers data through scientific way of method by maintaining empirical studies as base. Thus, the study employs positivism technique to examine the methods of risk management adopted by Nigerian commercial banks and to assess whether risk management practices adopted by banking sectors create sustained competitive advantages to banks or not.

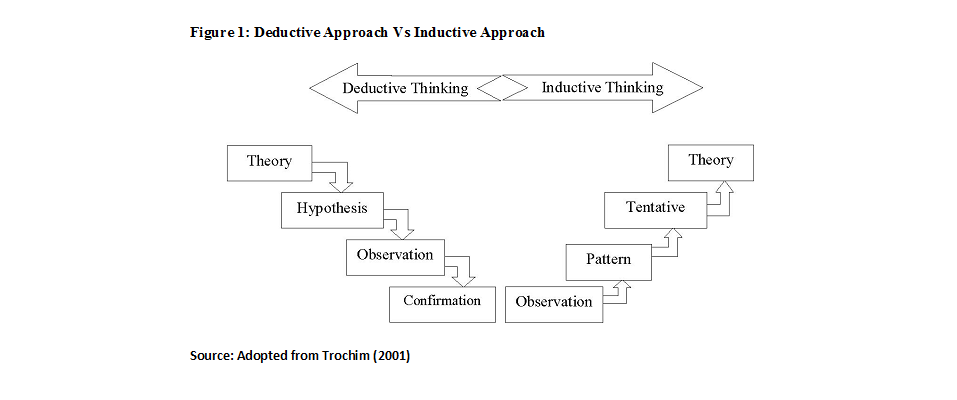

Research Approach

In a research methodology, the research approaches encompass two different practices such as the deductive and inductive approach.

Deductive approach

In deductive approach the answer given for the research question, research methodology is pointed out through examining several hypotheses. Sources procured from preceding literatures are studied to evaluate different hypothesis depending on the background of the study. This is superseded by the conception of research theory which executes to be the theoretical framework. Marcoulides (1998) stated that the systematized research hypothesis is then examined to evaluate and determine the research theory so as to reach the conclusion. The deductive approach is considered as top-down approach.

Inductive research approach

The methodology employed in the inductive research is contrary of the deductive methodology. In general, inductive research methodology originates with the assessment of the collected information which eventually paves way to the formulation of the research theory. The hypothesis is further processed depending on the developed theory. Therefore, this approach would enable in designing theories and conceptions depending on the previous developed experimental data (Marcoulides, 1998). The inductive is known as bottom up approach.

This study employs deductive approach in order to analyse the risks management practices implemented in commercial banks of Nigeria. The research framework is developed to identify the important factors related to risk management namely: analysis, risk identification, understanding and monitoring necessary for Nigerian commercial banks.

Research Strategy

One of the significant factors involved in the research methodology is to select a relevant research strategy depending on the objectives of the research study. The three major types of research strategy are as follows:

Qualitative approach

The qualitative approach adopts data analysis or interview process (classification of the data) in order to gather the non-numerical data. Some examples for qualitative data include non-verbal data like videos or images (Saunders et al., 2003).

Quantitative Approach

This approach implements data analysis or questionnaire process which encompasses in designing graphs or tabulating statistics to collect the numerical data.

Mixed Methods Approach

Mixed research approach includes both data collection practices of qualitative and quantitative research procedures. Johnson et al. (2004) illustrated that this type of research methodology significantly emphasizes on the problem rather than focusing on the type of approach implemented for collection of the data. Hence the research expert has no limitation to choose the data collection approach.

The current study adopts quantitative research methodology. Through quantitative approach, a survey was conducted with the bank authorities and officials to identify various types of risk faced by the commercial banks and funding institutions in Nigeria. Furthermore, the adopted approach helps to develop an estimate whether effective risk management methodologies facilitate the banks to accomplish a competitive advantage. The quantitative approach enables in determining the sustaining and influencing parameters that impose on the risk management methodologies of the Nigerian commercial banks. Hence this study implements a quantitative method to meet the study objective.

Justification of chosen research strategy

The present study employs quantitative research approach because it attempts to improve the generalizibility, replicability and objectivity of the findings. Quantitative approach collects the data in numerical format by conducting survey where questionnaire was used as survey instrument. The quantitative data helps to analyze the risk management practices employed by Nigerian commercial banks as well as to examine whether adopted risk management practices create competitive advantage to banking sectors. Therefore this study adopts quantitative approach so as to make the researcher to feel more confident on outcome of the study.

Time Horizon

The present study adopts cross-sectional research design due to limited time. The major benefit of cross-sectional research design is that it assists to gather extensive data from large sample size. Moreover, it is suitable to explain the incidence of a phenomenon or describe how factors are associated in various organizations (Saunders et al., 2011).

Sample Location and Target population

As per Owojori et al., (2011), the survey was carried out in Nigeria due to the significant growth and development of the banking industry. The determined population would be the staffs who hail from 23 commercial banks (i.e., ACB International Bank PLC., Access Bank Nig. Ltd, Afribank Nigeria Ltd., African Express Bank Nigeria, PLC., African International Bank Ltd., Allstates Trust Bank Ltd., Assurance Bank of Nigeria, PLC., Bond Bank Limited, Broad Bank of Nig. Ltd., Capital Bank International Limited, Centre Point Bank, PLC., Chartered Bank Ltd., Citi Bank, Citizens International Bank Ltd., City Express Bank PLC., Commercial Bank (Credit Lyonnais) Ltd., Commercial Bank of Africa Ltd., Co-operative Bank Plc., Co-operative Dev. Bank of Nigeria Ltd, Diamond Bank Ltd., Ecobank Nig. Plc., Eko International Bank of Nig. Plc, Equitorial Trust Bank Ltd.) in the two specified regions such as eastern and western region of Nigeria. The researcher personally approached each and every respondent in the bank and administered the well designed questionnaire during their leisure hours. Before administering the test, they were explained the scope of the study. Also, the researcher was gone through each and every questions answered by the respondent in the banks. The investigation period for this study is from 2000 to 2012 when the banking sectors were facing a drastic changeover.

Sampling

Several sampling procedures are available for data collection. Some of them include judgment sampling, systemic sampling, convenience sampling, random sampling techniques and many more. Conversely, non-probability sampling technique which is a purposive sampling method was employed. This technique involves each participant and every facet of the environment and activities are particularly chosen to collect information as implying other options cannot render the appropriate data (Maxwell, 2009).

Sample size

Sample size was restricted to 72 bank officers in Nigeria.

Data Collection Procedure

Primary data and Secondary data are the two types of data collection methods. In the present study, only primary data was used. Primary data collection method improves the quality and reliability of the study not by minimizing the errors but also by reducing the impact of the researcher’s opinions on the findings of the study. In the present study, the primary data was gathered through questionnaire method after obtaining the consent from the organizational authorities, where the samples were drawn.

Questionnaire

As per Creswell (2001), questionnaires are considered as the most cost-efficient data collection tools that enables in gathering large volumes of data at a short span of time. Moreover, the questionnaire gathers data in effective manner with less distortion when compared to interview method. A survey-based methodology was carried out through approaching various bank faculties in Nigeria. A questionnaire will be developed comprising of simple, rigid and close-ended questionnaires. The major purpose of the research is to examine the belief and attitude of the employees having high involvement in the firm. The participants are able to express their thoughts, beliefs and attitudes because of the anonymous feature of questionnaire

Mode of questionnaire

The survey questionnaire includes only closed ended questionnaire. The determination of framework is determined by certain question such as gender, age and occupation. Additionally, Likert scale was also implemented in the questionnaire to enable the participants to explicit their attitudes towards the organization. The Likert scale may begin with “strongly agree” and end with “strongly disagree” (Dundas, 2008).

Validity and Reliability

During the data collection procedure, the reliability and legitimacy of the study was assured. As per Tracy (2010), the consistency of the study was inclined by the fidelity of the respondents. Therefore, the survey involves only the bank employees, as they would be the ones who are suitable for the research study. The validity of the study is estimated by the design of the study to gauge the data (Marshall & Rossman, 2011; Tracy, 2010).

Pre testing

Pilot testing enables to enhance the efficiency of the study by assuring the reliability of the questionnaire. Pilot study was conducted with the small group of sample population. Nearly 10 participants were allotted in this study. Pilot study helps in enhancing the quality of the questionnaire just by not eliminating the improper questions but also enables in eliminating the questions which would lead to the biased responses. Through integrating the opinions from the supervisors and the participants, the quality of the questionnaire is made more appropriate. This testing is carried out at each and every stage of the study. Hence, pilot study executes to be an effective management tool that helps in figuring out the errors present in the questionnaire.

Ethical approaches

As per Burton (2000), the researcher during every single stage of the study, gives due regard to all possible ethical issues such as the data collection, data publication and the data analysis. The privacy aspect of the participants is assured by the researcher before executing the study. Also, the social demographic data such as name, mobile number, residential address, email Id were not collected from the respondents.

Informed consent

Informed consent is referred to be the significant factor for a research study. Therefore, this practice has been implemented in this research study to assure the study’s reliability. The research expert has clearly elucidated the study’s aims and rationale to all the respondents.

Data analysis

The collected data was registered into the excel sheet and then to the statistical software tool which employs SPSS version (21.0). Descriptive analysis was conducted through evaluating the percentages, mean, SD and the relationship between the definite variables were determined using the chi-square analysis.

Summary

This chapter briefly explains about the research technique and rationale employed for choosing various methods that is associated to the research. Moreover, it also provides justification for selecting appropriate research design, statistical methods, data collection techniques that are employed for data analysis. SPSS v.21.0 was employed for the data analysis process in order to analyze the quantitative data and also executes both inferential and descriptive statistics. The following chapter provides information on the outcome of the survey instrument.

Chapter IV: Results

Introduction

The present section illustrated the analysis and results of the quantitative data obtained using the study title “Is Effective Risk Management Practices be Competitive advantages for sustained earnings for commercial banks in Nigeria- An Empirical study” questionnaire, from the respondents. In the initial part of the analysis the data was first recorded in the excel sheet and later exported into the SPSS software which analysis the study results. The adopted version of SPPS is 21.0.1.Additionally in the initial phase the outliers, Missing data, and logical checks are analysed. During the analysis data accuracy was verified using the proof reading technique in the questionnaire against the SPSS data window.

In the present study, the formulated hypothesis is tested using the Regression and Correlation technique, which measures the dependent and Independent variables with the grouping variables. In this study the dependent variables are “Competitive advantage” independent variables are “Operational risk, Credit risk, Market risk and Liquidity risk” and moderating variable is “factors related to Risk management”.

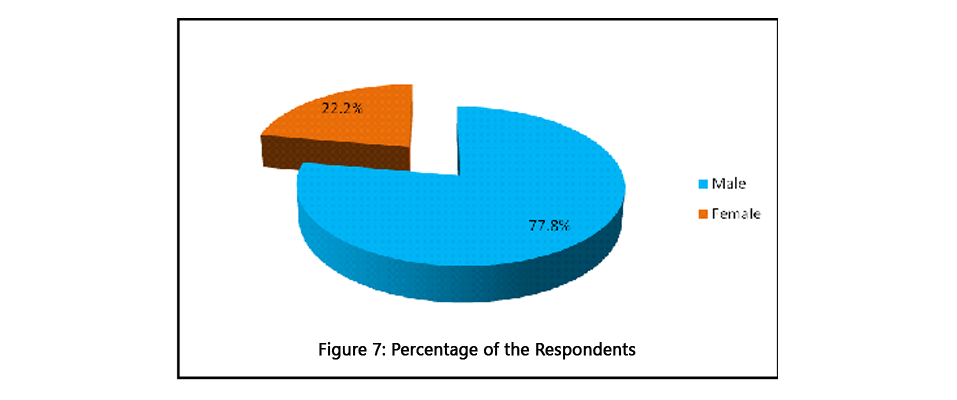

Demographic Characteristics

| Gender | Frequency | Percentage |

|---|---|---|

| Male | 56 | 77.8 |

| Female | 16 | 22.2 |

| Total | 72 | 100.0 |

Table 3 shows that majority of the respondents were male (78%), when compared to that of (22%) female, the survey method showed that both genders were well represented.

Table 4: Frequency for assessment and quantification of the Types of Risks

| Type of Risks | Annually | Semi-Annually | Quarterly | Bi-Monthly | Weekly | Daily |

|---|---|---|---|---|---|---|

| Environmental Risk | 21% | |||||

| Market Risk | 14% | |||||

| Operational Risk | 35% | |||||

| Credit Risk | 10% | |||||

| Legal Risk | 7% | |||||

| Liquidity Risk | 7% | |||||

| Reputational Risk | 7% |

From the Table 4, 35% of the respondents indicated that Operational Risk was assessed and quantified weekly followed by environmental risk according to 21% of the respondents noted it was done on a monthly basis. 14% and 10% of the respondents indicated that market risk and credit risk were assessed and quantified on a daily basis respectively.7% of the respondents said legal risk was assessed and quantified on a monthly basis, 7% of the respondents said liquidity risk was assessed and quantified on a daily basis and 7% said reputational risk was assessed and quantified on a semi-annually.

Table 5: How regular are the following risks formally managed

| Type of Risks | Annually | Semi-Annually | Quarterly | Bi-Monthly | Weekly | Daily |

|---|---|---|---|---|---|---|

| Environmental Risk | 7% | |||||

| Market Risk | 14% | |||||

| Operational Risk | 29% | |||||

| Credit Risk | 19% | |||||

| Legal Risk | 7% | |||||

| Liquidity Risk | 14% | |||||

| Reputational Risk | 10% |

From the Table 5 it is inferred that, 29% of the respondents responded to Operational Risk, which was managed bi-monthly followed by credit risk according to 19% of the respondents noted it was done on a weekly basis. 14% and 10% of the respondents indicated that market risk, liquidity and reputational risk were managed on a daily, weekly and annually basis respectively.7% of the respondents said environmental risk was managed on a semi-annually basis, 7% of the respondents said legal risk was managed on a quarterly basis.

Table 6: Relevance of Operational Risk Management to the Nigerian Banking Industry

| Options | Respondents | Percentage |

|---|---|---|

| Yes | 47 | 65.3 |

| No | 7 | 9.7 |

| I do not know | 18 | 25.0 |

| Total | 72 | 100.0 |

Table 6 explains about the relevance of operational risk to the banking industry in Nigeria, 65% of the respondents answered “Yes” with another 25% indicating that Operational Risk Management was not relevant. The remaining 10% did not know whether operational risk was relevant in the banking industry or not.

Table 7: Availability of Internally developed Operational Risk Management processes or guidelines

| Options | Respondents | Percentage |

|---|---|---|

| Yes | 47 | 62.5 |

| No | 27 | 37.5 |

| Total | 72 | 100.0 |

Table 7 explains whether their banks have internally developed Operational Risk Management processes or guidelines, 63% of the respondent answered “Yes” with the remaining 38% indicating that their banks had not developed any Operational Risk Management processes or guidelines internally.

Table 8: Perceived sources of competitive advantage in bank

| Options | Respondents | Percentage |

|---|---|---|

| Staff | 14 | 19.4 |

| Strength of network | 6 | 8.3 |

| Primary position in domestic business | 9 | 12.5 |

| Image and Reputation | 7 | 9.7 |

| Product differentiation | 6 | 8.3 |

| Internal guidelines and policy on operational risk management | 7 | 9.7 |

| Technology | 23 | 31.9 |

| Total | 72 | 100.0 |

From Table 8, it is inferred the perceived sources of competitive advantage in bank. The respondents were asked to indicate which of the listed factors is perceived to be a source of competitive advantage for their banks. 32% of them said Technology, 19% of them said Staff with another 13% and 10% indicating primary position in domestic business and image and reputation were sources of competitive advantage respectively. Another 10% of the respondents said bank’s internal guidelines and policies on Operational Risk Management is a source of competitive advantage with 8% opting for product differentiation. The final 8% said bank’s strength of network was a source of competitive advantage.

Correlation Analysis

H1: There is a significant relationship among the different type of risk experienced by Nigerian Commercial Bank namely (a) operational risk (b) market risk (c) credit risk (d) liquidity risk and Competitive Advantage

Table 9: Correlation between Types of risks and Competitive advantage

| Options | Respondents | Operational Risk | Market Risk | Credit Risk | Liquidity Risk | Competitive advantage |

|---|---|---|---|---|---|---|

| Operational Risk | r-value | - | .598** | .624** | .745** | .769** |

| p-value | 6 | .000 | .000 | .000 | .000 | |

| Market Risk | r-value | - | .779** | .820** | .816** | |

| p-value | .000 | .000 | .000 | |||

| Credit Risk | r-value | - | .893** | .893** | ||

| p-value | .000 | .000 | ||||

| Liquidity Risk | r-value | - | .980** | |||

| p-value | .000 | |||||

| Competitive advantage | r-value | - | ||||

| p-value |

The table 9 presents the Pearson correlation analysis. The correlation analysis shows the relationship between two or more variables and this illustrated as r and p value, while r is degree of correlation and p signifies significance level. It is evident from the table that operational risk (r = 0.769, p < 0.01), market risk (r = 0.816, p < 0.01), credit risk (r=0.893, p<0.01) and liquidity risk (r = 0.980, p < 0.01) does showed significant positive relationship with competitive advantage. The correlation value ranged from 0.598-0.980. The correlation values are positive, which illustrates that all the all types of risks are important for creation of competitive advantage as indicated by the employees. However, operational risks was showed medium to high correlation than other risks, while liquidity was considered an important risk in order to create competitive advantage of the firm as revealed by the participants.

Regression analysis

The below section, further reveals the support for the formulated hypothesis, to test the positive relation between competitive advantage and types of risk which can be achieved though regression analysis. The regression tool is considered to be the most powerful tool provides the strength of the association while correlation provides only linear relationship. Accurate interpretation of the independent variable can be achieved only through regression technique. The independent variables were expressed in terms of the unstandardized factor scores (beta coefficients) and r square were included. Based on the beta coefficient the significant factors in the regression equation were indicated in an importance based order. The dependent variable, overall level of outcome was measured on a 5-point Likert-type scale.

H2: There is a significant association among the type of risk and Competitive Advantage

Table 10: Association between types of risk and Competitive advantage

| Model | Unstandardized Coefficients Risk | Adjusted R-square | F-change | t | P-value | ||

|---|---|---|---|---|---|---|---|

| Beta | S.E | ||||||

| 1 | (Constant) | .118 | .108 | 0.959 | 1664.387 | 1.094 | .278 |

| Liquidity Risk | .975 | .024 | 40.797 | .000** | |||

| 2 | (Constant) | -.009 | .116 | 0.962 | 6.454 | -.075 | .940 |

| Liquidity Risk | .910 | .034 | 26.382 | .000** | |||

| Operational risk | .101 | .040 | 2.541 | .013** | |||

| 3 | (Constant) | .804 | .059 | 0.964 | 4.780 | .856 | .395 |

| Liquidity Risk | .804 | .059 | 13.655 | .000** | |||

| Operational risk | .113 | .039 | 2.882 | .005** | |||

| Credit Risk | .075 | .034 | 2.186 | .032* | |||

Dependent variable: Competitive advantage, ** P<0.01; * P<0.05

In table 10 the step-wise regression analysis for the study is performed, in which the beta coefficient of the regression of competitive advantage on ‘Liquidity risk’ is significant (beta=0.975, t=40.797, p=0.000). Since the significance is less than alpha 0.05 values, the null hypothesis is rejected and hence there is a support of the hypothesis. Thus, there is a significant association between ‘Competitive advantage and ‘Liquidity Risk’ and Independent variables together accounted for 96 % of the variance (R square) which indicates that ‘Liquidity Risk’ is a significant predictor of competitive advantage.

When added operational risk to liquidity risk it is found that the beta coefficient of the regression of competitive advantage on ‘operational risk’ is significant (beta=0.101, t=2.541, p=0.013<0.01). Since the significance is less than alpha 0.05 values, the null hypothesis is rejected and hence there is a support of the hypothesis. Thus, there is a significant association between ‘Competitive advantage and ‘operational risk’ and Independent variables together accounted for 96% of the variance (R square) which indicates that competitive advantage is more significant predictor of ‘operational risk’.

When added Credit risk with operational risk and liquidity risk it is found that the beta coefficient of the regression of competitive advantage ‘credit risk’ is significant (beta=0.075, t=2.186, p=0.032<0.05). Since the significance is less than alpha 0.05 values, the null hypothesis is rejected and hence there is a support of the hypothesis. Thus, there is a significant association between ‘Competitive advantage and ‘credit risk’ and Independent variables together accounted for 96 % of the variance (R square) which indicates that ‘credit risk’ is a significant predictor of competitive advantage. Overall, liquidity management is important for the firms as per the beta value.

H3: There is a significant relationship between risk management practices namely: analysis, risk identification, understanding and monitoring and competitive Advantage.

Table 11: Association between factors related to risk management and Competitive advantage

| Model | Unstandardized Coefficients Risk | Adjusted R-square | F-change | t | P-value | ||

|---|---|---|---|---|---|---|---|

| Beta | S.E | ||||||

| 1 | (Constant) | .056 | .042 | 0.994 | 11128.456 | 1.310 | .195 |

| Understanding Risk | .993 | .009 | 105.491 | .000** | |||

| 2 | (Constant) | .012 | .039 | 0.995 | 18.475 | .302 | .763 |

| Understanding Risk | .785 | .049 | 15.985 | .000** | |||

| Analysis | .217 | .051 | 4.298 | .000** | |||

| 3 | (Constant) | -.024 | .039 | 0.995 | 8.553 | -.609 | .544 |

| Understanding Risk | .538 | .096 | 5.586 | .000** | |||

| Analysis | .321 | .060 | 5.379 | .000** | |||

| Risk Monitoring | .149 | .051 | 2.925 | .005** | |||

Dependent variable: Competitive advantage, ** P<0.01