Tools used for Analysis and Evaluation of Investment Strategies

In Brief:

- In this article, we are going to discuss some of the major tools used for analysis and evaluation of investment strategies which will develop the tools much easier than before.

- In order to identify future research topics, we have reviewed the business & management field (recent peer-reviewed studies).

- Analysts can utilize a range of variables to allow them to make smarter investing selections, such as previous gains, income prospects, commodity price, and so on.

Introduction

Through processes and acquisitions, businesses produce income and revenues. Manufacturing and offering products are the sole functions of businesses. An initiative, from a business standpoint, is any value stream with the expectation of generating more revenue than it costs over the course of its useful life. Buying shares, for example, is an acquisition because the hope is that the share price will grow in value and be available for purchase at a greater price at a later period. For Analysis and Evaluation of Investment, contact tutorsindia.com. Our experts offer help in survey tool and instrumentation development.

What is Investment Analysis?

The word “investment analysis” encompasses a wide range of activities. As a result, it contains a wide range of computations and evaluations that examine market trends, investments, and financial businesses. Meanwhile, analysts can utilize a range of variables to allow them to make smarter investing selections, such as previous gains, income prospects, commodity price, and so on.

The dissertation topics are selected based on the research gap and future recommendations proposed by previous researchers. Tutors India topic selection is driven by your research question that is interested in exploring. We conduct surveys for Master’s Dissertation Help and also for tool development.

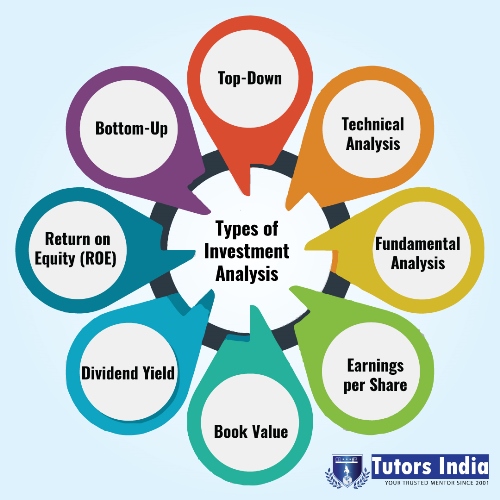

Types of Investment Analysis

With so much accurate and timely financial expertise at their disposal, industry insiders employ a range of techniques. However, investment analysis can be performed even further into a few distinct types.

Bottom-Up

Personal equities are evaluated based on their qualities in bottom-up analysis. These attributes include, for illustration, control over the price, managerial skills, and appraisal. However, when determining stocks and bonds, this equity research method does not consider financial or price fluctuations. Instead, irrespective of the circumstances of the business or economy, this approach looks at the finest firms and equities. If you find difficulty with research topic selection, you can contact tutors India, our experts help you in coming up with innovative, trendy research topics in your area of research. In addition, we are well-versed in Questionnaire development, and in particular, Questionnaire development for dissertation.

Top-Down

Before adopting a more precise investment strategy, top-down assessment analyses macroeconomic, commercial, and industry changes. Assume an investigator examines different sectors and discovers that innovations surpass financials. As a result, individuals may elect to invest more in financial statements than in electronics in their strategy. They’ll then look for the banking sector’s best when it comes to businesses. An investor may commit a considerable amount of funds in an integrated technology stock.

Technical Analysis

Technical analysis is concerned with identifying similarities in stock price movements through the examination of a service’s pricing and quantity of share trading. While quantitative research emphasizes on a stock’s underlying value, trading strategy assesses a safety’s relative strengths and weaknesses by examining a number of quantitative plotting tools, investment signals, and price fluctuations. You will find the best project management tools and techniques for future researchers enrolled in business and management. These topics are researched in-depth at the University of Glasgow, UK, Sun Yat-sen University, University of St Andrews and many more.

Fundamental Analysis

Fundamental analysis is based on the assumption that assets have an inherent or business worth that the market will probably recognize. The investor must examine the company’s overall condition in order to determine this value. Financial managers examine the situation of the company’s industry and general health of the economy. To evaluate a company’s worth, fundamental analysts utilize variables such as earnings-per-share (EPS), dividend yield, price-earnings (P/E) ratio, and return on capital. You can always rely on Tutors India for Thesis Questionnaire development. We are the Best Dissertation Writing UK, and avail our services for all your Master’s business and management Dissertation Writing.

Earnings per Share

The efficiency with which profits are sent down to stakeholders is measured by earnings per share. Investors could split profits left for shareholders by the shares issued to get a company’s financial performance. Customers may perceive a corporation as successful if its net profit is significant.Download our project management tools and techniques on related Reference book papers such as tutorials, proprietary materials, research projects and many more @ tutorsindia.com/academy/books.

Book Value

The price-to-book ratio can be used by speculators to find cheap high-growth enterprises. While an industry’s book value is equivalent to the quantity of current assets minus total debt, the P/B is computed by subtracting the market rate of its shares by the book value per share. A low P/B ratio indicates that a company is cheap.In order to identify the reflective report topics, we have reviewed the report (recent peer-reviewed topics) on business and management.

Dividend Yield

The correlation between an industry’s stock dividends and its stock price is known as the dividend yield. Start dividing the cash increase by the current stock price to find the dividend yield. The dividend yield of one corporation can then be compared to that of another. If traders want to invest in firms that pay out a lot of dividends, they should find companies with greater dividend yields. Tutors India offers the Premier Finance and Economics research paper writing services and coursework help around the world especially popular in the UK, UAE, Australia and Asian countries.

Return on Equity (ROE)

The return on equity (ROE) essentially reflects a company’s effectiveness in converting shareholder capital into revenues. The operating earnings from a company’s income statement is combined with the stockholders’ assets from its accounting records to calculate ROE. As a result, if a corporation decides to sell its assets to cover up loans, the value remaining over for stockholders is known as ROE. We are the Best Master’s Dissertation Writing UK, and avail our services for all your Master’sDissertation Writing.

Conclusion

There are a variety of financial analytical techniques that can be used to evaluate a profit potential. Including various evaluations in your study may aid you in making a more informed purchase decision. The greater data and analysis you have, the more accurate your review will be.

Reference

https://smartasset.com/financial-advisor/investment-analysis

Previous Post

Previous Post