Dissertation on Forecasting the London Stock Exchange Using Artificial Neural Networks

Introduction

The use of Artificial Neural Networks (ANNs) to predict the London Stock Exchange is investigated and analysed in this dissertation. The significance of ANN in predicting future financial market patterns and values is proved in particular. This study has made a number of contributions to the field. The study’s initial contribution is to identify the optimal subset of connected factors affecting the London stock market at both the local and international levels, which will be utilised in future research.

The only feasible approach to assess the forecasting model is to build a trading system utilising the predicting model and test it against the evaluation criteria. There has been a lot of previous study on determining the best trading technique for a forecasting challenge. The purpose of this thesis is to avoid debating whether technique is the best. Although the value of a trading strategy cannot be overstated, this thesis focuses on taking an existing strategy, modifying it, and comparing the returns using forecasting models (Thakkar and Chaudhari 2021). You will find the best dissertation for future researchers enrolled in engineering and Management. These topics are researched in-depth at the University of Glasgow, UK, Sun Yatsen University, University of St Andrews and many more.

However, there is always dispute in academic research about how to accurately assess the ANN trading model. Some university researchers claimed that anticipating the stock exchange’s direction may lead to larger earnings, while others said that predicting the stock exchange’s value could result in higher return rate. We have a well-trained team Tutors India to assist the scholars about stock exchange in a better way.

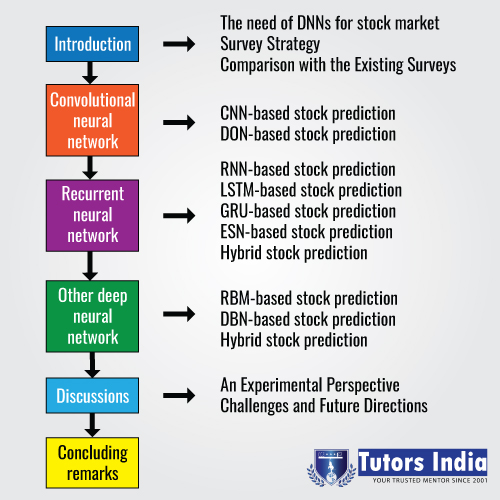

Fig1. 1. A graphical overview of forecasting the Stock Exchange using ANN

Source: Thakkar and Chaudhari (2021)

Financial Time Series Forecasting

Financial Timeline Using previous and present data or information, forecasting seeks to uncover underlying patterns, trends, and anticipate future index value. Historic values are constant and evenly spaced values across time that reflects a variety of data sets. The fundamental goal of forecasting is to discover a rough transformation matrix between the input parameters and the predicted or output value (Liu et al. 2021). Tutors India has vast experience in developing dissertation topics for student’s pursuing the UK dissertation in business management. Order Now

The purpose of the time series model is to extract the structure from the mistake by determining the pattern’s trend and seasonality. Moving average (section), linear regression with time, and other approaches are employed in time series forecasting. Time series varies from technical analysis (section) in that it is based on samples and uses non-chaotic time series to treat the values. We have our Tutors India professionals to suggest the scholars to learn more about forecasting the London Stock Exchange using Artificial Neural Networks (ANN). Download our dissertation related Reference book & papers such as tutorials,proprietary materials, research projects and many more @

Artificial Neural Network (ANN)

An Artificial Neural Network (ANN), commonly known as a “Neural Network” (NN), is a data-processing paradigm application of computational or mathematical methods used by the biological nervous system (brain) to analyse data. The extraordinary design of the information system is one of this paradigm’s most distinctive and crucial features. It is composed of a densely linked collection of processing components, similar to neurons, with each set of elements coupled by weighted connections that accept a variety of real-valued inputs and provide real-valued output (Moradi et al. 2021).

Feed Forward Neural Networks (FFNN)

The most effective and frequently used models in predicting difficulties are feed forward neural networks. Multi-layer perceptrons is another term for them. The network’s output is provided by, where h is the hidden layer’s number of neurons, n represents the number of inputs, and the variables are the network’s parameters.

Radial Basis Function Neural Networks (RBFNN)

RBFNNs (radial basis function neural networks) are nonlinear hybrid networks that have gained a lot of attention from academics because of their simplicity, speed of training, and excellent prediction precision. They’ve been employed in a number of applications including pattern recognition.

Probablistic Neural Networks (PNN)

Researchers have employed probabilistic neural networks extensively in prediction and classification challenges.

Recurrent Networks (RNN)

The input layer’s activity patterns or the networks hidden layers activations traverse through the system more than once, and output values are being sent back through the network as inputs while generating a new output pattern (Sánchez-Serrano et al. 2020).

Conclusions

The forecast model and operating system development technique given in this thesis are intended to motivate other academic scholars to explore neural network innovation in finance. There is still a long way to go before an efficient forecasting model based on ANN can be constructed to anticipate stock market price behaviour. However, by finding and recording persistent abnormalities that occur, a great lot of depth may be added to the existing approaches for developing the ANN, which will undoubtedly assist to create a stronger forecasting model. In order to identify the future dissertation topics, we have reviewed the dissertation (recent peer-reviewed topics) on both engineering and management. Order Now.

Future Research

This dissertation has successfully attempted to develop an accurate forecasting model using ANN then using a modified trading strategy to obtain a higher rate of return. It has succeeded in meeting its goals to some measure. However, have not examined alternative computational intelligence approaches such as fuzzy logic, genetic algorithms, or new statistical methodologies, hence can these be predicted in the future.

We believe that the above explanation helps the scholars to know more about writing dissertation about forecasting London stock exchange. Also we provide excellent training service for all kind of dissertation help through Tutors India.

References

- Liu W, Wang C, Li Y, et al (2021) Ensemble forecasting for product futures prices using variational mode decomposition and artificial neural networks. Chaos, Solitons & Fractals 146:110822. https://doi.org/10.1016/j.chaos.2021.110822

- Moradi M, Jabbari Nooghabi M, Rounaghi MM (2021) Investigation of fractal market hypothesis and forecasting time series stock returns for Tehran Stock Exchange and London Stock Exchange. Int J Financ Econ 26:662–678. https://doi.org/10.1002/ijfe.1809

- Sánchez-Serrano JR, Alaminos D, García-Lagos F, Callejón-Gil AM (2020) Predicting Audit Opinion in Consolidated Financial Statements with Artificial Neural Networks. Mathematics 8:1288. https://doi.org/10.3390/math8081288

- Thakkar A, Chaudhari K (2021) A comprehensive survey on deep neural networks for stock market: The need, challenges, and future directions. Expert Syst Appl 177:114800. https://doi.org/10.1016/j.eswa.2021.114800

Previous Post

Previous Post Next Post

Next Post